(Finance) – Caution prevails on Wall Street, with investors focusing their attention on central banks’ decisions on interest rates as the risks of a global recession increase. The Fed’s decision is expected tomorrow, then it will be up to the Bank of England on Thursday and that of Japan on Friday.

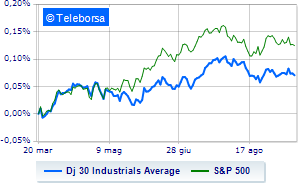

Among US indices, the Dow Jones the session continues with a slight drop of 0.65%; along the same line, theS&P-500, which loses 0.52%, trading at 4,430 points. Slightly negative Nasdaq 100 (-0.5%); along the same line, slightly decreasingS&P 100 (-0.51%).

All sectors slide on the American S&P 500 list. Among the most negative on the S&P 500 list, we find the sectors power (-1.15%), secondary consumer goods (-1.01%) e industrial goods (-0.98%).

The only Blue Chip of the Dow Jones is substantially up IBM (0%).

The strongest sales, however, occur at Walt Disneywhich continues trading at -3.40%.

Without momentum Dowwhich trades at 0%.

United Health is stable, reporting a moderate 0%.

The negative performance of Intelwhich falls by 1.59%.

Between protagonists of the Nasdaq 100, Enphase Energy (+4.64%), Modern (+2.94%), Kraft Heinz (+1.44%) e Sirius XM Radio (+1.22%).

The strongest sales, however, occur at MercadoLibrewhich continues trading at -3.57%.

Align Technology drops by 2.39%.

Decline decided for Amazonwhich marks -2.28%.

Under pressure Starbuckswith a sharp decline of 2.21%.