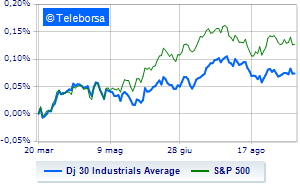

(Finance) – Cautious Wall Street continues the session at the levels of the day before, with the Dow Jones which stops at 34,673 points, while, on the contrary, theS&P-500 proceeds in small steps, advancing to 4,460 points. Slightly positive Nasdaq 100 (+0.32%); on the same trend, in fractional progress theS&P 100 (+0.22%).

Investors’ eyes are on the central banks waiting to know the outcome of the meetings of the FOMC (Wednesday) and the Bank of England (Thursday) and Bank of Japan (Friday).

In recent days it has emerged that inflation continues to be high. According to insiders, the Fed on Wednesday it will opt for the status quo, keeping rates at the highest level in 22 years. However, the indications that the number one of the central bank will provide will be important, Jerome Powellon future moves.

Positive result in the S&P 500 basket for sectors informatics (+0.68%), power (+0.45%) e industrial goods (+0.44%). At the bottom of the ranking, significant declines are evident in the sector secondary consumer goodswhich reports a decline of -0.78%.

Among the best Blue Chips of the Dow Jones, Apple (+2.26%), Visa (+1.67%), Travelers Company (+1.33%) e Honeywell International (+1.11%).

The worst performances, however, are recorded on American Expresswhich gets -2.22%.

Lame Boeingwhich shows a small decrease of 1.13%.

Modest descent for Walgreens Boots Alliancewhich drops a small -1.03%.

Thoughtful Nikewith a fractional decline of 0.73%.

To the top between Wall Street tech giantsthey position themselves Sirius XM Radio (+2.38%), Apple (+2.26%), Atlassian (+2.12%) e ON Semiconductor (+1.84%).

The steepest declines, however, occur at Modernwhich continues the session with -8.29%.

The negative performance of Tesla Motorswhich fell by 2.43%.

Polished drops by 2.36%.

Decline decided for Trade Deskwhich marks -2.27%.