(Finance) – Positive session for the Milanese stock exchange and the other European stock exchangeswhich are inspired by the indications received yesterday from ECB on rates and the new stimuli launched by central bank of China. Some are expected in the afternoon important US macro datasuch as New York’s Empire State Index and Industrial Production, which will provide a snapshot of the health of manufacturing.

No significant changes forEuro / US Dollar, which trades on the day before at 1.066. Slightly rising seat for thegold, which advances to 1,917.7 dollars an ounce. Oil (Light Sweet Crude Oil) is essentially stable at 90.61 dollars per barrel.

On equality, yes spreadwhich remains at +175 basis points, with the yield on the 10-year BTP standing at 4.40%.

Among the main European stock exchanges supported Frankfurtwith a decent gain of 0.97%, good ideas on Londonwhich shows a large lead of 0.80%, and excellent performance for Pariswhich recorded an increase of 1.55%.

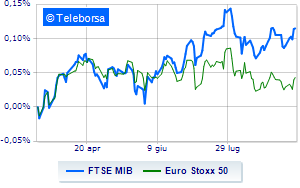

The Milanese price list shows a timid gain, with the FTSE MIB which is achieving +0.63%; along the same lines, the FTSE Italia All-Share advances fractionally, reaching 31,005 points. Slightly positive FTSE Italia Mid Cap (+0.21%); on equality the FTSE Italia Star.

Among the best Blue Chips of Piazza Affari, well set out Record yourselfwhich shows an increase of 2.31%.

Toned Moncler which highlights a nice advantage of 2.27%.

In light Ferrariwith a large increase of 1.74%.

Positive trend for DiaSorinwhich advances by a discreet +1.6%.

The worst performances, however, are recorded on Amplifonwhich obtains -1.87%.

Weak Italian postwhich recorded a decline of 0.63%.

At the top among Italian shares a mid-cap, Sesa (+3.57%), Eurogroup Laminations (+3.46%), Maire Tecnimont (+2.79%) e WIIT (+2.41%).

The worst is GVSwhich lost 2.33%.

Under pressure De’ Longhiwhich suffered a decline of 2.22%.

It slides Antares Visionwith a clear disadvantage of 2.08%.

It moves below parity LU-VE Grouphighlighting a decrease of 1.50%.