(Finance) – Reduction broken down by Adobe Systemswhich exhibits a deadweight loss of 4.18% on previous values, despite the overall third quarter results being better than market expectations.

In the three months ended Sept. 1, the San Jose company reported net profits growing to 1.40 billion, equal to 3.05 dollars per share, compared to 1.14 billion, (2.42 dollars per share) recorded in the same period of the previous year. On an adjusted basis, EPS rose from $3.40 to $4.09, versus the consensus of $3.98.

THE revenues they grew from 4.43 to 4.89 billion, against the 4.87 billion estimated by analysts. For the current quarter, Adobe expects earnings per share (EPS) of between $4.10 and $4.15, versus the $4.06 expected by the market.

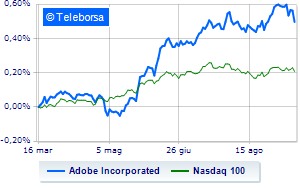

The scenario on a weekly basis of Photoshop and Acrobat maker detects a loosening of the curve compared to the force expressed by the Nasdaq 100. This retreat could make the stock subject to sales by operators.

The medium-term technical implications are always read in a bullish light, while in the short term we are witnessing a weakening of the bullish push due to the evident difficulty in proceeding above USD 535.8. The most immediate support level controlling the current phase seen in the 524.3 area is still valid. The most consistent expectations favor an extension of the corrective movement towards 519.6, which will occur in a reasonably short time.