(Finance) – Piazza Affari building, which does not match the moderately bullish trend of the main European markets. On Wall Street, theS&P-500 trading continues to decline. After the ECB this week, markets are looking to the decisions that will be made next week by the Federal Reserve.

On the currency market, slight growth inEuro / US Dollar, which rises to 1.067. Plus sign forgold, which shows an increase of 0.86%. Sitting on parity for oil (Light Sweet Crude Oil), which stands at 90.57 dollars per barrel.

It advances a little spreadwhich reaches +177 basis points, highlighting an increase of 3 basis points, with the yield on the 10-year BTP equal to 4.44%.

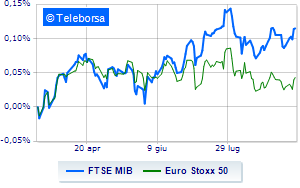

Among the main European stock exchanges composed Frankfurtwhich grows by a modest +0.56%, modest performance for Londonwhich shows a moderate increase of 0.50%, and a decidedly positive balance for Paris, which boasts an increase of 0.96%. Piazza Affari continues the session at the levels of the day before, reporting a change of +0.08% on FTSE MIB; on the same line, remains at the starting line FTSE Italia All-Share (Business Square), which is positioned at 30,833 points, close to previous levels.

Between best performers of Milan, highlighted Stellantis (+1.89%), Leonardo (+1.56%), Telecom Italia (+1.16%) e Moncler (+1.08%).

The worst performances, however, are recorded on Amplifonwhich gets -2.98%.

Basically weak Italian postwhich recorded a decline of 1.12%.

It moves below parity ERGhighlighting a decrease of 1.08%.

Moderate contraction for STMicroelectronicswhich suffers a decline of 1.02%.

At the top among Italian shares a mid-cap, Sesa (+4.56%), December (+3.52%), Maire Tecnimont (+3.17%) e Eurogroup Laminations (+2.11%).

The strongest sales, however, occur at Rai Waywhich continues trading at -4.66%.

In red Antares Visionwhich highlights a sharp decline of 3.40%.

The negative performance of Secowhich fell by 3.36%.

Safilo drops by 2.74%.