For the first time since July 2022, no expert was able to anticipate with certainty the next move of the European Central Bank (ECB). Was it going to ease its monetary policy carried out in recent months to counter the explosion in prices or not? This Thursday, September 14, the board of governors, meeting in Frankfurt, did not deviate: for the tenth time in a row in more than a year, the European institution raised its interest rates, brought to a new record.

But caution is required. The increase is once again “only” 0.25 points – compared to increases of 0.50 or 0.70 points in the past. Determined, the ECB nevertheless seems to be starting to feel its way. Its president, Christine Lagarde, was careful not to say whether the next meeting scheduled for October 26 would give rise to a new increase, but the tightening cycle is probably coming to an end.

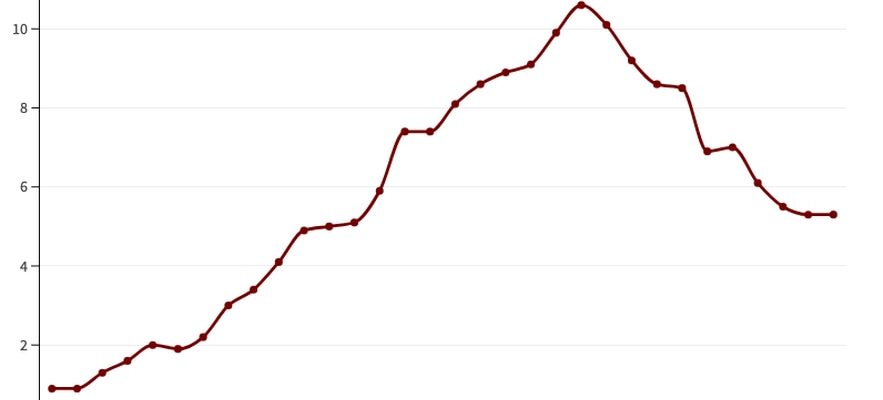

The ECB wants to bring inflation down to 2%

© / The Express

A difficult dilemma

The final objective has not changed: 2% inflation is still in the institution’s sights. However, it still seems out of reach. In August, price increases in the area remained high, at 5.3% year-on-year and even seemed to be heading towards a plateau. Not enough to reassure the President of the ECB, who reaffirmed the ambitions of her house during the traditional post-meeting press conference. According to the latest forecasts from the Central Bank, inflation is not expected to approach its fateful target before the end of 2025…

In the meantime, the European economy is lagging. Germany could find itself in recession for the whole of 2023 and the Netherlands is likely to follow suit. Further tightening would increase the risk of dragging the entire euro zone into the red. What would be the consequences of simply maintaining rates, but at these high levels? The inflation/growth dilemma continues to give Frankfurt a cold sweat.