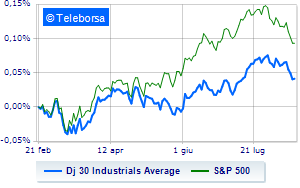

(Tiper Stock Exchange) – The performance of the New York Stock Exchange is weakwith the Dow Jones which stands at 34,510 points; on the same line, stay flat theS&P-500, with the quotations standing at 4,366 points. Slightly down the NASDAQ 100 (-0.32%); along the same lines, in fractional decline theS&P 100 (-0.21%).

Appreciable rise in the S&P 500 for the compartment power. At the bottom of the ranking, significant declines are manifested in the sector telecommunicationswhich reports a decrease of -1.21%.

Investors are looking to China’s real estate crisis and problems in the shadow banking system of Asia’s largest economy to see if there could be negative spillovers to global markets. Operators are also wondering about the course of US monetary policy at the end of a week that was once again marked by strong macroeconomic data. With no major economic data expected today, analysts’ attention is already on Federal Reserve Chairman Jerome Powell’s speech at the Jackson Hole Economic Symposium next week.

“We think Powell’s tone in Jackson Hole will be less even-tempered than the July FOMC minutes,” analysts wrote at Bank of America – Reliance on Fed data makes the minutes a bit out of date as the meeting took place before the release of above-consensus 2Q GDP and, of course, the robust July data stream. The latest data would likely heighten policymakers’ concerns about a renewed acceleration in inflation, driven by strong aggregate demand. Therefore, we expect that Powell to implicitly or explicitly oppose the rate cut that markets are pricing in in 2024“.

Among the companies that have released the accounts last night closed market, farfetch communicated a disappointing outlook after a mixed second quarter, while Applied materials disclosed a better-than-expected outlook after a positive third quarter. Among the major companies that have disclosed the results this morning, Deere raised its full-year earnings guidance after a positive third quarter, while Estee Lauder released a disappointing outlook on the continuing challenges it faces in Asia.

It collapses WeWorkwhich announced its intention to carry out a reverse stock split to remain listed on the NYSE, e runs Bloomin’ Brandsafter The Wall Street Journal reported that activist investor Starboard Value has built a stake of more than 5% in the company, becoming one of the top five shareholders.

Among the best Blue Chips of the Dow Jones, Wal-Mart (+1.64%), United Health (+1.13%), Chevrons (+0.93%) and cisco systems (+0.89%).

The strongest sales, on the other hand, show up Johnson & Johnson, which continues trading at -0.73%. He hesitates Nike, which drops 0.67%. Basically weak Goldman Sachswhich recorded a decrease of 0.61%.

Between best performers of the Nasdaq 100, Ross Stores (+5.93%), Datadog (+3.26%), Applied materials (+2.75%) and Sirius XM Radio (+1.89%).

The strongest sales, on the other hand, show up JD.com, which continues trading at -5.21%. Hands-on sales PDD Holdings, which suffers a decrease of 3.90%. Slide Modern, with a clear disadvantage of 3.45%. In red global foundrieswhich shows a marked decrease of 2.10%.