(Tiper Stock Exchange) – Hesitant debut for Wall Streetwhich opened trades little move after some exits macroeconomic data higher than expectedwhich would seem to support the hypothesis of other Fed interventions on rates.

One is currently widely awaited Federal Reserve “hiatus” in September, at the next monetary policy meeting, but strong growth in retail sales coupled with today’s manufacturing data could convince bankers to take further action to calm inflation. More will be known tonight with the publication of the Minutes of the Fed.

In the meantime, the construction market has shown signs of strength, reporting a 3.9% increase in construction sites started in July, while the figure for industrial production is higher than expected, with growth of 1% in July.

The attention of operators is now focused on Fed Minutesout tonight, to get some more information on the next strategies of the US central bank.

On the front Corporate some negative news has arrived: bad results from Target, which cut the guidance for the current year, while Intel has renounced the purchase of Tower Semiconductor and Tesla has further reduced the prices of its cars in China.

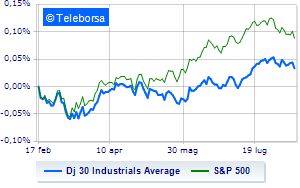

Meanwhile in New York, the index Dow Jones leads by 0.45% to 35,104 points, while hovering around parity onS&P-500 around 4,446 points. On equality also the NASDAQ 100 and theS&P 100 (+0.13%).