(Finance) – It’s going back a lot Beyond Meatwhich exhibits a negative percentage change of 16.66%.

The plant-based burger maker revised its full-year revenue estimate downwards to $360-380 million versus its previous guidance’s range of $375-415 million. In the second quarter, revenues fell 30.5% to $102.1 million and below the $108.4 million consensus estimate.

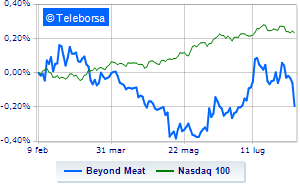

The technical scenario seen in one week of the title compared to the index NASDAQ 100shows a slowdown in the trend of Beyond Meat compared toindex of US technology stocksmaking the stock a potential target for investors to sell.

The medium-term technical implications are always interpreted in a bullish key, while in the short term we are witnessing a weakening of the bullish push due to the evident difficulty in proceeding beyond the 13.14 USD level. The most immediate level of support to control the current phase seen in the 12.09 area is always valid. The most coherent expectations are in favor of an extension of the corrective move towards 11.45 to occur in a reasonably short time.