(Finance) – A bearish start for the Wall Street stock exchange with investors concerned about data on Chinese trade that indicate a slowdown in the global economy.

Traders’ sentiment is also weighed down by fears for the stability of stocks US banks which, after the rating cut by Fitchthey also cash in on the downgrade of Moody’s: These are ten small and medium-sized banks, including M&T Bank and Pinnacle Financial. The credit agency also placed some large banks on watch, such as Bank of New York Mellon and US Bancorp, which could soon face a downgrade.

Meanwhile, insiders are wondering when the Federal Reserve will start cutting i interest rates. Second John Williamspresident of the New York Fed, a reduction in the cost of money will be possible in the first half of 2024, while for Michelle Bowman, a member of the Fed board, further hikes may be needed if inflation fails to reach the 2% target. The wait is therefore rising for an update on the price trend which will arrive this week, Thursday 10 August, and will be able to help clarify the picture for the Federal Reserve’s next moves.

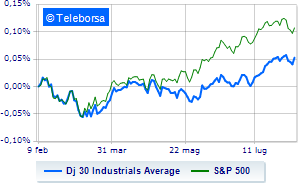

Among US indices, the Dow Jones it is down (-0.71%) and stands at 35,223 points; along the same lines, theS&P-500 it has a depressed trend and trades below the previous levels at 4,488 points. Negative changes for the NASDAQ 100 (-0.78%); with similar direction, fractionally decreasing theS&P 100 (-0.55%).

The sector stands out in the S&P 500 basket sanitary. In the lower part of the classification of the S&P 500 basket, significant declines are manifested in the sectors power (-1.96%), materials (-1.82%) and financial (-1.39%).

At the top of the rankings American giants components of the Dow Jones, Amgen (+3.97%), boeing (+2.98%), Johnson & Johnson (+2.40%) and Caterpillar (+1.88%).

The strongest declines, however, occur on Applewhich continues the session with -1.73%.

Between best performers of the Nasdaq 100, Monster Beverage (+6.13%), Booking Holdings (+5.87%), MercadoLibre (+4.83%) and Amgen (+3.97%).

The strongest declines, however, occur on Modernwhich continues the session with -6.46%.

They focus their sales on Enphase Energywhich suffers a drop of 3.25%.

Sales on polishwhich records a drop of 3.17%.

Bad sitting for Atlassianwhich shows a loss of 2.68%.