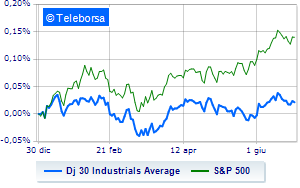

(Tiper Stock Exchange) – Earnings day for the New York Stock Exchangewith the Dow Jones, which shows a capital gain of 0.77%; along the same lines, slight increase forS&P-500, which rises to 4,395 points. Consolidate the levels of the eve the NASDAQ 100 (-0.11%); in fractional progress theS&P 100 (+0.28%). Financial (+1.59%), materials (+1.17%) and industrial goods (+0.78%) in good light on the S&P 500. The sector telecommunicationswith its -0.44%, is the worst in the market.

The major US banks they all passed the annual stress tests, proving to be able to weather a severe recession. “The results confirm that the banking system remains strong and resilient,” said Fed Vice Chairman for Oversight Michael Barr. It is important to remember that only the largest banks are required to pass these tests and that the problems of the past months have affected medium-sized and regional banks.

On the front of quarterly, Micron it posted a smaller-than-expected loss in the third quarter on demand for its memory chips from AI-driven applications. BlackBerry reported surprise adjusted profit in the first quarter.

Between more news, Lordstown Motors received a notice of delisting from the Nasdaq, just days after the company filed for bankruptcy, and Eli Lilly announced the acquisition of Sigilon Therapeutics to develop treatments for diabetes.

Some interesting news come on macroeconomic data. US gross domestic product increased at an annualized rate of 2.0% in the first quarter (revised upwards from last month’s 1.3% reading), while new jobless claims fell.

Between protagonists of the Dow Jones, Goldman Sachs (+3.47%), JP Morgan (+3.09%), Visa (+2.83%) and Honeywell International (+1.75%).

The worst performances, however, are recorded on intel, which gets -1.33%. Moderate contraction for Walgreens Boots Alliance, which suffers a drop of 1.19%. Undertone Wal-Mart showing a filing of 0.94%.

On the podium of the Nasdaq stocks, polish (+7.20%), Rivian Automotive (+5.77%), Paccar (+2.58%) and American Electric Power Company (+2.14%).

The strongest declines, however, occur on Micron Technology, which continues the session with -3.24%. Prey of sellers Atlassian, with a decrease of 3.11%. They focus their sales on PDD Holdings, which suffers a drop of 2.97%. Sales on MercadoLibrewhich records a drop of 2.54%.