In a few years, life insurance has been able to transform itself from a traditional envelope, even a little old-fashioned, based on funds in euros, into a sharp financial management tool, grouping together numerous financial products. If the first remains unavoidable as the base of savings, the second allow to seek performance. They bring together a wide variety of investments, including stocks, bonds and real estate. But there are many others, to discover to take advantage of all the attractions of your contract.

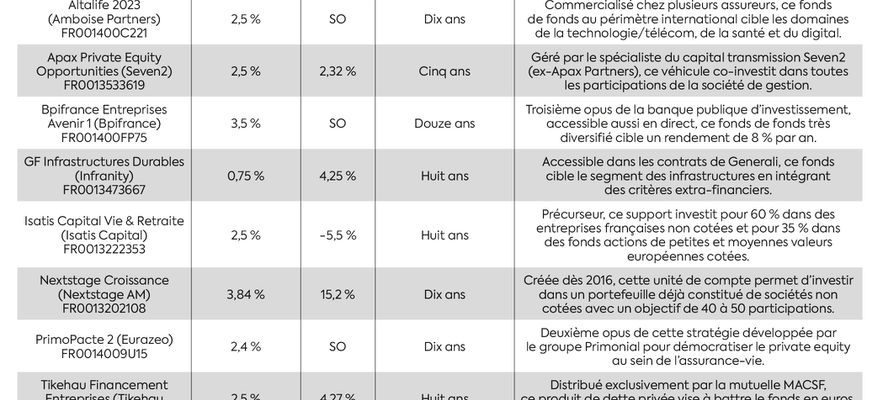

The unlisted. Private equity funds (or private equity) give access to unlisted companies in full development, one of the most profitable investments. It is thus possible to expect up to 10% per year. The other side of the coin is that the capital is normally blocked there for eight to ten years. “We took the decision to take charge of the liquidity on this asset class, relates Dominique Collot, marketing director of the insurer Suravenir, which released a range of unlisted account units last September. There are exit costs for the first five years, but then the insured can sell whenever he wants free of charge.” Several large companies have already made this choice.

© / The Express

However, these funds should be used for diversification. “They can be intended for any type of saver, in proportions which depend on his risk profile”, estimates Dominique Collot. From this point of view, life insurance offers great comfort since it allows you to invest modest sums (from a few hundred to several thousand euros) whereas directly, it takes several tens of thousands of minimum euros.

Less gain, but less risk…

Be aware, moreover, that the unlisted is not limited to the private equity. It can also relate to private debt and investments in infrastructure, which have a lower potential for gain, but also a lower risk. The GF Infrastructures Durables support, managed by Infranity and accessible at Generali, is one of the pioneers in this field. It combines debt and capital with a strong bias in favor of the energy transition. “these are real assets that offer attractive diversification, income stability and good protection against rising interest rates and inflation,” says Philippe Benaroya, founding president of Infranity. The fund targets a net return of more than 4% per year.

ETFs. One of the major advantages of listed index funds or exchange-traded funds (ETFs)? They are very simple to understand: they exactly replicate the performance of a market index (CAC 40, S & P 500, Nasdaq, MSCI World, etc.). We are talking about passive management, as opposed to traditional funds, where the manager selects securities that aim to outperform the index.

Another major difference is the level of management fees. On ETFs, they are around 0.20 to 0.30% per year, against an average of 2.02% for unit-linked shares, according to the specialized site Good Value for Money. A gap that gives ETFs a head start in terms of performance.

The SPIVA survey conducted by the financial group S&P Global regularly assesses the ability of active funds to achieve their objective. With inglorious results. According to this player, only 10% of European equity vehicles have achieved this over the past five years. Results vary by market, but the deeper and more liquid the market, the better ETFs fare. Conversely, active management will be more effective on small and mid-caps or on very specific themes. You can of course combine these approaches together, thus benefiting from the best of both worlds. Main difficulty: accessing these units of account that are still not widely used.

An advantageous tax framework

Vivid titles. Funds have the advantage of diversification since with a single medium, you are exposed to a multitude of securities. The other side of the coin is that you no longer really know where your savings are invested. Hence the enthusiasm for individual actions when they are accessible. At the broker Placement-direct.fr, the latter collect 10% of the outstandings of its flagship contract, Placement-direct Vie. Altaprofits, which offers a dedicated contract (Titres@Vie), notes this: “Customers are interested in it because it allows them to very clearly materialize their savings”, underlines Stellane Cohen, its president.

Life insurance also benefits from an advantageous tax framework, including at the time of transmission. However, it has a weak point: you never know at what price you will buy or sell the security because there is a delay between the moment you place the order and when it is executed. “On Placement-direct Vie, if you enter your order before noon, it is placed the same evening at the closing price for European and American shares”, announces Gilles Belloir, CEO of Placement-direct.fr. Elsewhere, count from one to three days of delay.

You should also know that you can only hold shares referenced in your contract: large French and European capitalizations most of the time. Another notable element: the management fees are often higher on the part of the contract invested in shares (except at Boursorama Banque). Finally, a minimum amount is required for each action, from a few hundred to a few thousand euros. However “it is necessary to diversify its portfolio of shares on 10 to 20 titles”, warns Gilles Belloir. The total sum to be mobilized is therefore high.

Priority to social impact

Solidarity funds. Since January 1, 2022, each contract must offer at least one green, responsible and solidarity fund. However, the latter are still little known because they are mainly marketed through employee savings. 90% of the capital is directed to traditional securities such as shares or bonds and 5 to 10% in solidarity organizations with strong social utility. These may be solidarity real estate companies providing access to housing, microcredit organisations, etc. “In this pocket, priority is given to the social impact and not to the financial performance, underlines Loïc Dano, savings product manager at the Maif. But by combining it with the 90% invested traditionally, the expected return is very close to that of traditional funds.”

These products are labeled by an independent committee within the Fair association (formerly Finansol). “The main criterion is the solidarity nature of the fund, indicates Frédéric Tiberghien, its president. We must prove its usefulness for populations in a situation of exclusion. We also check that the product is really marketed and the moderate nature of management costs. ” In addition, the label requires, for the non-solidarity part, a socially responsible management.

Within its “Responsible and Solidarity” life insurance, Maif also offers a solidarity fund in euros. “The latter invests a minimum of 2.5% of its 3 billion euros in assets in solidarity organizations or projects”, highlights Karine Leymarie, head of investment and sustainable finance expertise at Maif. No other insurer has followed suit yet.