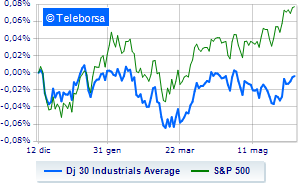

(Finance) – Wall Street continues the session at the levels recorded on the eve, reporting a variation of -0.02% on the Dow Jones; on the same line, stay flat theS&P-500, with the quotations standing at 4,299 points. Fractional earnings for the NASDAQ 100 (+0.33%); with the same direction, theS&P 100 (+0.27%).

Investor focus remains focused on central banks, after recent macroeconomic data, in particular the increase in jobless claims in the US, seem to point to caution on interest rates at the next Federal Reserve meeting.

In light of the North American S&P 500 the sub-funds secondary consumer goods (+0.65%) and informatics (+0.49%). At the bottom of the ranking, the biggest declines occur in the sub-funds materials (-1.01%) and industrial goods (-0.53%).

Between protagonists of the Dow Jones, Salesforce (+1.81%), United Health (+1.05%), Merck (+0.64%) and Wal-Mart (+0.57%).

The strongest declines, however, occur on intelwhich continues the session with -2.51%.

Decided decline for Dowwhich marks a -2.07%.

Under pressure 3Mwith a sharp drop of 1.67%.

Small loss for Home Depotwhich trades with -1.2%.

Between protagonists of the Nasdaq 100, Adobe Systems (+4.02%), Tesla Motors (+3.77%), Netflix (+3.14%) and Advanced Micro Devices (+2.53%).

The strongest declines, however, occur on Old Dominion Freight Linewhich continues the session with -2.99%.

He suffers Warner Bros Discoverywhich shows a loss of 2.64%.

Prey of sellers CrowdStrike Holdingswith a decrease of 2.56%.

They focus their sales on intelwhich suffers a drop of 2.51%.