(Tiper Stock Exchange) – Wall Street is thwarted, with investors treading cautiously ahead of inflation data and the stock exchange meeting Federal Reserve of next week. Meanwhile, the Bank of Canada raised the overnight reference rate to 4.75%, the highest level in the last 22 years, against analysts’ expectations for rates unchanged at 4.50% at today’s meeting.

On the macroeconomic frontthe American trade deficit increased in April 2023, mortgage applications were still decreasing, and crude inventories decreased in the last week.

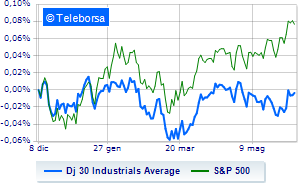

Looking at i main indicessalt the Dow Jones with a +0.25%, while, on the contrary, theS&P-500, with the quotations standing at 4,278 points. Down the NASDAQ 100 (-1.1%); on the same line, just below parity theS&P 100 (-0.46%).

They stand out in the S&P 500 basket i sectors power (+2.54%), utilities (+1.51%) and industrial goods (+1.30%). In the lower part of the classification of the S&P 500 basket, significant declines are manifested in the sectors telecommunications (-1.28%), informatics (-1.01%) and secondary consumer goods (-0.46%).

To the top between Wall Street giants, Caterpillar (+3.83%), Goldman Sachs (+2.60%), Chevrons (+2.05%) and Dow (+1.81%).

The strongest sales, on the other hand, show up Microsoft, which continues trading at -2.74%. Down Merck, which marks a -2.31%. negative Visawhich trades with -1.9%. Salesforce is down, reporting -2.63%.

On the podium of the Nasdaq stocks, Warner Bros Discovery (+5.38%), Microchip Technology (+4.06%), NXP Semiconductors (+3.38%) and global foundries (+3.12%).

The strongest declines, however, occur on Datadog, which continues the session with -6.77%. Bad performance for DexCom, which records a drop of 4.75%. Black session for ANSYS, which leaves a loss of 4.68% on the table. At a loss work daywhich drops by 4.67%.