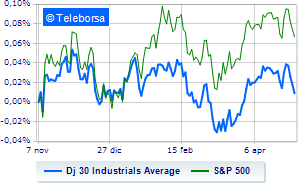

(Finance) – Negative session for Wall Street, with the Dow Jones which is leaving 0.79% on the fence, continuing the bearish trail of four consecutive declines, which started last Monday; along the same lines, slightly decreasingS&P-500, which continues the day below parity at 4,074 points. On the levels of the eve the NASDAQ 100 (+0.03%); slightly negative theS&P 100 (-0.42%).

The Federal Reserve decided yesterday to raise interest rates by 25 points, as expected by the market. The US central bank has opened to a pause in rate hikes due to signs of an economic slowdown. In this regard, concern is growing among investors about a new US regional bank in crisis, PacWest.

The sector is clearly visible in the S&P 500 utilities. In the price list, the sectors financial (-1.25%), sanitary (-0.70%) and industrial goods (-0.66%) are among the best sellers.

Between protagonists of the Dow Jones, intel (+3.37%), Microsoft (+0.96%) and Amgen (+0.68%).

The worst performances, however, are recorded on Walt Disneywhich gets -3.44%.

Under pressure American Expresswith a sharp drop of 2.98%.

He suffers Caterpillarwhich shows a loss of 2.44%.

Prey of sellers Goldman Sachswith a decrease of 2.31%.

Between best performers of the Nasdaq 100, Datadog (+14.96%), Cognizant Technology Solutions (+7.84%), Modern (+5.01%) and Constellation Energy (+3.54%).

The worst performances, however, are recorded on Qualcommwhich gets -5.62%.

Letter about Regeneron Pharmaceuticalswhich records a significant drop of 5.44%.

Goes down Warner Bros Discoverywith a drop of 4.75%.

They focus their sales on MercadoLibrewhich suffers a drop of 3.59%.

Between macroeconomic quantities most important of the US markets:

Thursday 04/05/2023

1.30pm USA: Challenger Layoffs (previously 89.7K units)

2.30pm USA: Trade Balance (Expected -$63.3Bn; Previous -$70.6Bn)

2.30pm USA: Productivity, Quarterly (Expected -1.8%; Previous 1.6%)

2.30pm USA: Unit Labor Cost, Quarterly (Expected 5.5%; Previous 3.3%)

2.30pm USA: Initial Jobless Claims, Weekly (Expected 240K; Previously 229K).