(Tiper Stock Exchange) – Seat not for the Milan Stock Exchangewhich does much worse than the other European markets, on a day characterized by a generally negative climate, on continuing turbulence in the US banking sector and after that the Fed raised rates by 25 basis points to 5.25%, it abolished forward guidance and opened the door for a prolonged pause in the increase in the cost of money.

However, investors’ attention is now turned to the next weak link in the financial sector, after the bailout of First Bank from JPMorgan; PacWest Bancorpanother regional institution, has in fact announced that it is evaluating various strategic options, including that of the sale.

Today’s session of the European price lists is however focused on the choices of the ECB and on words of the president Christine Lagardeas well as on the continuation of the company quarterly.

L’Euro / US Dollar it is substantially stable and stops at 1.107. L’Gold maintains substantially stable position at 2,042.8 dollars an ounce. Light Sweet Crude Oil was up slightly, advancing to $68.41 per barrel.

Slightly increase it spreadswhich reaches +188 basis points, with a slight increase of 2 basis points, with the yield of the 10-year BTP equal to 4.15%.

In the European stock market scenario sales focus on Frankfurtwhich suffers a decline of 0.83%, sales up Londonwhich recorded a drop of 0.82%, and a negative session for Pariswhich shows a loss of 1.04%.

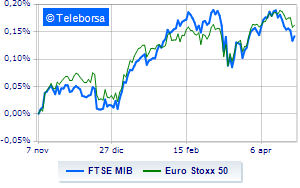

TO Business SquareThe FTSEMIB it is down (-1.07%) and stands at 26,549 points; along the same lines, the FTSE Italia All-Share it lost 1.04%, continuing the session at 28,683 points. Negative the FTSE Italia Mid Cap (-0.92%); along the same lines, negative changes for the FTSE Italy Star (-1.17%).

Best performers among the most capitalized Italian stocks, Ferrari it advanced by 2.92%, after confirming its guidance and recording a sharp growth in the first quarter.

The strongest sales, on the other hand, show up Leonardo, which continues trading at -3.84%. Under pressure MPS Bank, which shows a drop of 3.23%. Heavy STMicroelectronics, which marks a drop of as much as -2.81 percentage points. Slow day for BPM deskwhich marks a drop of 2.45%.

At the top of the mid-cap rankings from Milan, Cembre (+2.22%), Ariston Holding (+1.47%), Alerion Clean Power (+1.45%) and Antares Vision (+1.23%).

The strongest sales, on the other hand, show up Maire Tecnimont, which continues trading at -7.77%. Slide GV extension, with a clear disadvantage of 3.88%. Composed believe, which grows by a modest -2.97%. In red IRENwhich shows a marked decrease of 2.59%.