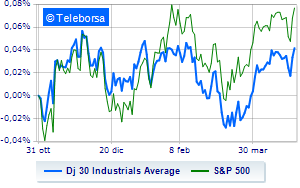

(Finance) – Slight increase for the Wall Street Stock Exchange, with the Dow Jones which rises by 0.66% to 34,049 points; along the same lines, theS&P-500 proceeds in small steps, advancing to 4,163 points. Slightly positive the NASDAQ 100 (+0.28%); on the same trend, in fractional progress theS&P 100 (+0.5%).

Inflation in the United States slowed down in March, but is still higher than market expectations. The measure monitored by the Federal Reserve to calculate it, the PCE (personal consumption expenditures price index) data, increased by 0.1% compared to the previous month and grew by 4.2% compared to a year earlier, after 5.1 % in February, against expectations for +4.1%.

The sectors are distinguished in the S&P 500 basket power (+1.76%), financial (+1.21%) and materials (+1.15%).

Between protagonists of the Dow Jones, intel (+4.49%), Walt Disney (+2.40%), Caterpillar (+2.26%) and Dow, (+2.21%).

The strongest sales, on the other hand, show up IBMwhich continues trading at -0.52%.

Between protagonists of the Nasdaq 100, Charter Communications (+7.38%), Warner Bros Discovery (+4.55%), intel (+4.49%) and Mondelez International (+4.29%).

The worst performances, however, are recorded on Datadogwhich gets -4.22%.

Bad sitting for T-Mobile USwhich drops by 3.95%.

Decided decline for CrowdStrike Holdingswhich marks a -3.64%.

Under pressure Atlassianwith a sharp drop of 3.51%.

Among macroeconomic appointments which will have the greatest influence on the performance of the US markets:

Friday 04/28/2023

2.30pm USA: Personal income, monthly (exp. 0.2%; prev. 0.3%)

2.30pm USA: Personal expenses, monthly (exp. -0.1%; prev. 0.1%)

2.30pm USA: Labor cost index, quarterly (exp. 1.1%; previous 1%)

3.45pm USA: PMI Chicago (exp. 43.5 points; previous 43.8 points)

4:00 pm USA: University of Michigan Consumer Confidence (expected 63.5 points; previous 62 points).