(Tiper Stock Exchange) – On Wall Street, the rise in the Nasdaq stands outthanks to good results of the technological giants, while the other main indices are flat. Both the parent company of Google (alphabet) That Microsoft beat first-quarter earnings expectations. The decision of the British Antitrust of block the acquisition from 69 billion dollars of Activision Blizzard by the Redmond giant. Still on the tech front, Meta Platforms will release today the data of the first quarter after the close of trading.

Investors continue to assess the health of the banking sectorafter yesterday First Republic Bank reported that he has lost over $100 billion in deposits in the first quarter it announced its intention to cut budgets and expenses by reducing executive compensation, reducing offices and laying off 20%-25% of the workforce. Meanwhile, investors are eagerly awaiting the monetary policy decision of the Federal Reserve of 3 May, for which an increase of 25 basis points in the cost of money is expected.

Before the bell they have arrived several quarterly interesting: CM extension saw a jump in quarterly earnings on volatile markets; boeing expects to increase 737 production and confirmed cash flow target; Hilton raised guidance after positive first quarter; general dynamics reported revenues increased to $9.9 billion in the first quarter; Chipotle reported higher-than-expected revenue and earnings in the first quarter.

On the macroeconomic frontUS durable goods orders increased more than expected in March, inventories increased marginally in the same month, weekly mortgage applications returned to growth, and crude inventories decreased more than expected.

As for the recommendations of analysts, Tesla suffers a downgrade of Jefferies to Hold da Buy, following last week’s warning of continued price cuts.

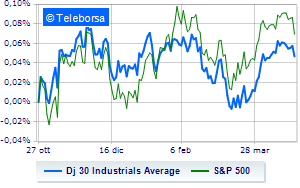

The Dow Jones it stands at 33,511 points; along the same lines, a day without infamy and without praise for theS&P-500, which remains at 4,080 points. In cash the NASDAQ 100 (+1.22%); with analogous direction, in fractional progress theS&P 100 (+0.52%).

Informatics (+2.28%) and secondary consumer goods (+0.54%) in good light on the S&P 500 list. Among the most negative on the S&P 500 list, we find compartments utilities (-1.71%), sanitary (-1.34%) and industrial goods (-0.95%).

To the top between Wall Street giants, Microsoft (+8.18%), boeing (+3.04%), intel (+1.82%) and Salesforce, (+1.10%).

The strongest sales, on the other hand, show up Merck, which continues trading at -2.31%. The negative performance of United Healthwhich drops by 2.24%. Home Depot drops by 2.20%. Decided decline for Amgenwhich marks a -2.17%.

Between best performers of the Nasdaq 100, Datadog (+14.18%), Lucid Group, (+10.31%), Microsoft (+8.18%) and Atlassian (+6.05%).

The worst performances, however, are recorded on Enphase Energy, which gets -24.16%. It collapses Activision Blizzard, with a drop of 10.87%. Hands-on sales Old Dominion Freight Line, which suffers a decrease of 9.56%. Under pressure Marriott Internationalwith a sharp drop of 3.22%.