(Tiper Stock Exchange) – Weak session for Wall Streetwith investors who await the quarterly reports of the technological giants. During this week they disseminate the data alphabet (parent company of Google), Amazon And Meta Platformsbut also other multinationals such as intel, Mondelez International, ExxonMobil And MasterCard. Between numbers arrived todaythose of stand out Coca Colawhich registered a first quarter beyond expectations despite the price increase it implemented on its products.

The Nasdaq was negativeon which the negative performance of Teslaafter the EV maker raised its 2023 capex forecast (it expects to spend between $7 billion and $9 billion this year, higher than its previous forecast of $6-8 billion).

As for the others corporate announcements, Eli Lilly has signed an agreement to sell a drug to Amphastar in a $1 billion deal, while Disney has begun its second wave of layoffs (bringing total job cuts in recent weeks to 4,000 by the time this round is completed).

I’m not here today important data in the calendar. Among the few insights, the FED Chicago National Activity Index (CFNAI) remained at -0.19 points in March 2023.

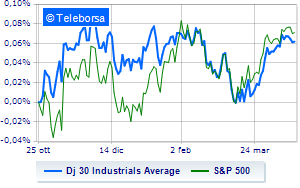

The Dow Jones stops at 33,795 points; on the same line, remains at the starting line theS&P-500 (New York), which stands at 4,126 points, close to the previous levels. In fractional decline the NASDAQ 100 (-0.61%); on the same trend, just below parity theS&P 100 (-0.29%).

Featured prominently in the S&P 500 i compartments power (+1.56%) and sanitary (+0.45%). In the price list, the sectors informatics (-0.90%) and secondary consumer goods (-0.60%) are among the best sellers.

Between protagonists of the Dow Jones, Chevrons (+1.44%), Caterpillar (+1.12%), Goldman Sachs (+0.82%) and United Health (+0.74%).

The strongest sales, on the other hand, show up Salesforce, which continues trading at -2.08%. In red Microsoft, which shows a marked decrease of 2.01%. The negative performance of intelwhich drops by 1.88%. American Express drops by 1.60%.

Between protagonists of the Nasdaq 100, Baker Hughes Company (+2.07%), Diamondback Energy (+1.58%), Monster Beverage (+1.16%) and eBay (+1.10%).

The worst performances, however, are recorded on PDD Holdings, which gets -4.96%. Decided decline for JD.com, which marks a -3.48%. Under pressure Tesla Motors, with a sharp drop of 2.79%. He suffers Datadogwhich shows a loss of 2.45%.