(Tiper Stock Exchange) – Wall Street is slow movingdespite a strong start to the banking quarterly season. JPMorgan Chase (first quarter profit up 52%), citigroup (first quarter profit up 7%) e Wells Fargo (first quarter profit up 32%) beat analysts’ estimates thanks above all to the increase in interest rates, signaling the resilience of the sector after the crisis that affected several regional banks in March. Remaining in the financial field, BlackRock reported declining first-quarter earnings, but solid inflows.

Weighing on investor sentiment are the data on retail sales in March, who suggested the economy was losing steam, with consumers cutting back on purchases of cars and other big-box items. Among other macro data, i import-export prices USA in March, while the industrial production in the same month.

On the front of monetary policythe president of the Atlanta Fed, Raphael Bosticsaid another rate hike of 25 basis points may allow the US central bank to end its tightening cycle with some confidence that inflation will steadily return to the 2% target.

Christopher Wallera member of the Federal Reserve Board of Governors, said monetary policy needs to be tightened further and that it will have to remain restrictive for a considerable period of timeand for longer than the markets expected.

Between titles under observation There are boeingafter it halted deliveries of some 737 MAXs due to a supply shortage at Spirit AeroSystemsAnd Lucid Groupwhich reported lower production and delivery figures in the first quarter than in the previous three months.

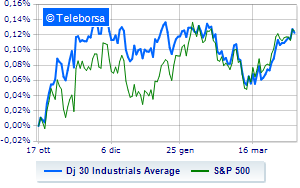

Stop around parity la New York Stock Exchangewith the Dow Jones which stands at 34,029 points; along the same lines, moves around parity theS&P-500, which continues the day at 4,150 points. On equality the NASDAQ 100 (-0.13%); on the same trend, without direction theS&P 100 (+0.1%).