(Tiper Stock Exchange) – Positive results for Piazza Affari, which shows a significant advantage over the rest of Europe where caution reigns. On the New York Stock Exchange, theS&P-500, after inflation slowed more than expected even though the core reading is still elevated, keeping a May hike in play. The market is betting on a 0.25% rate hike by the Fed at its May 3 meeting and will look to tonight’s minutes for confirmation.

Insiders are also waiting for the start of the quarterly season in the United States which kicks off next Friday, April 14, with the results of three major banks, such as: citigroup, JPMorgan Chase & Co And Wells Fargo.

On the currency market, the session rose slightly due toEuro / US Dollar, which advances to 1.098. L’Gold maintains substantially stable position at 2,006.4 dollars an ounce. Positive session for oil (Light Sweet Crude Oil), which shows a gain of 1.09%.

Slight improvement spreadswhich drops to +180 basis points, with a drop of 2 basis points, while the yield on the 10-year BTP stands at 4.13%.

Among the markets of the Old Continent moderately good day for Frankfurtwhich rises by a fractional +0.31%, session without momentum for Londonreflecting a moderate increase of 0.50%, e Paris is stable, reporting a moderate +0.09%.

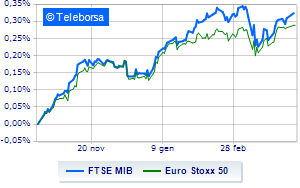

Seat up slightly for Piazza Affari, with the FTSEMIB, which advances to 27,629 points, continuing the series of three consecutive increases, which began last Thursday; along the same lines, the FTSE Italia All-Share proceeds in small steps, advancing to 29,809 points.

Without direction the FTSE Italia Mid Cap (-0.18%); in fractional decline the FTSE Italy Star (-0.36%).

Among the best Blue Chips of Piazza Affari, sustained Unicreditwith a decent gain of 2.61%.

Good insights on BPERwhich shows a large lead of 1.95%.

Well set up MPS Bankwhich shows an increase of 1.58%.

Small step forward for CNH Industrialwhich shows a progress of 1.50%.

The strongest sales, on the other hand, show up STMicroelectronicswhich continues trading at -1.74%.

It moves below parity ENIshowing a decrease of 0.86%.

Moderate contraction for Telecom Italywhich suffers a drop of 0.71%.

Undertone Moncler showing a filing of 0.69%.

Between best stocks in the FTSE MidCap, GV extension (+2.30%), MFE B (+2.22%), Fincantieri (+2.11%) and Luve (+1.98%).

The strongest declines, however, occur on Drywhich continues the session with -2.91%.

Prey of sellers Saraswith a decrease of 2.77%.

They focus their sales on Saint Lawrencewhich suffers a drop of 2.17%.

Sales on Brembowhich records a drop of 1.98%.

Among macroeconomic appointments which will have the greatest influence on the performance of the markets:

Wednesday 04/12/2023

01:50 Japan: Production prices, monthly (exp. -0.3%; previous -0.3%)

01:50 Japan: Core Machinery Orders, Monthly (Exp. -7.8%; Previous 9.5%)

2.30pm USA: Consumption prices, yearly (expected 5.2%; previous 6%)

2.30pm USA: Consumption prices, monthly (expected 0.2%; previous 0.4%)

4.30pm USA: Oil inventories, weekly (exp -583K barrels; prev -3.74M barrels).