(Tiper Stock Exchange) – Session with little movement for the European stock exchanges, including Piazza Affariwith investors that are waiting for important data from the United States. Indeed, US inflation data for March and the minutes of the last FOMC meeting will be released today, with both information likely to change market expectations on the Fed’s next moves.

In the Eurozone today there are no relevant data on the agenda. Yesterday the International Monetary Fund (IMF) said it sees growth in the euro area of 0.8% in 2023 and 1.4% in 2024 (the estimates for Italy are less optimistic, at 0.7% and 0. 8% respectively). This morning the Bank of Italy announced that private sector deposits fell 2.4% year-on-year in February, following a 1.8% drop in January, while loans to households grew 2.5% from 3% of the previous month.

L’Euro / US Dollar the session continued at the previous levels, reporting a variation of +0.1%. Slight increase forgold, which shows an increase of 0.29%. Slight increase for the petrolium (Light Sweet Crude Oil), which shows an increase of 0.18%.

On the levels of the eve it spreadswhich remains at +183 basis points, with the yield of the 10-year BTP which stands at 4.10%.

Among the main European Stock Exchanges essentially tonic Frankfurtwhich recorded a capital gain of 0.24%, moderate gain for Londonwhich increases by 0.60%, and small steps forward for Pariswhich marks a marginal increase of 0.34%.

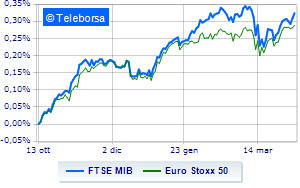

Slight increase for the Milan Stock Exchangewhich shows on FTSEMIB a rise of 0.43%, continuing the bullish trend highlighted by three consecutive gains, triggered last Thursday; along the same lines, slight increase for the FTSE Italia All-Sharewhich rises to 29,826 points.

On the levels of the eve the FTSE Italia Mid Cap (+0.02%); with the same direction, it consolidates the levels of the previous day FTSE Italy Star (-0.18%).

At the top of the ranking of the most important titles of Milan, we find BPER (+2.42%), Iveco (+2.32%), Is in the (+1.96%) and Unicredit (+1.42%).

The strongest sales, on the other hand, show up STMicroelectronicswhich continues trading at -1.45%.

Modest descent for DiaSorinwhich drops a small -1.18%.

Thoughtful Registera fractional decline of 0.68%.

Among the protagonists of the FTSE MidCap, MFE B (+2.94%), Ascopiave (+2.56%), CIR (+1.72%) and Illimity Bank (+1.66%).

The strongest sales, on the other hand, show up Saraswhich continues trading at -1.49%.

He hesitates Sesawith a modest drop of 1.44%.

Slow day for Salcef Groupwhich marks a decrease of 1.43%.

Small loss for De Nora Industrieswhich trades with -1.34%.