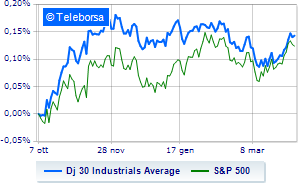

(Finance) – Wall Street continues the session at the levels recorded on the eve, reporting a change of +0.01% on Dow Joneswhile, on the contrary, theS&P-500 makes a small leap forward of 0.27%, reaching 4,101 points. Slightly positive the NASDAQ 100 (+0.63%); as well, in fractional progress theS&P 100 (+0.44%).

Tomorrow, due to the Easter holidays, the US markets will be closed on Good Friday, while they will reopen on Monday 10 April, Easter Monday.

Featured prominently in the S&P 500 are the sub-funds telecommunications (+1.29%) and informatics (+0.59%). In the price list, the sectors power (-0.92%) and materials (-0.52%) are among the best sellers.

At the top of the rankings American giants components of the Dow Jones, Microsoft (+1.67%), Honeywell International (+0.87%), Amgen (+0.63%) and Travelers Company (+0.56%).

The strongest sales, on the other hand, show up Caterpillarwhich continues trading at -1.63%.

He hesitates Salesforce,with a modest drop of 1.36%.

Slow day for IBMwhich marks a decline of 0.99%.

Small loss for Visawhich trades at -0.98%.

To the top between Wall Street tech giantsthey position themselves Micron Technology (+3.58%), alphabet (+2.72%), alphabet (+2.70%) and CSX extension (+2.41%).

The worst performances, however, are recorded on AirBnbwhich gets -4.05%.

In red Applied materialswhich shows a marked decrease of 2.28%.

The negative performance of Costco Wholesalewhich drops by 2.22%.

Enphase Energy drops by 1.83%.

Among macroeconomic appointments which will have the greatest influence on the performance of the US markets:

Thursday 06/04/2023

1.30pm USA: Challenger layoffs (expected 65K units; previously 77.77K units)

2.30pm USA: Initial Jobless Claims, Weekly (Expected 200K; Previously 246K)

Friday 07/04/2023

2.30pm USA: Unemployment rate (expected 3.6%; previous 3.6%)

2.30pm USA: Variation in employment (expected 238K units; previous 311K units)

Monday 10/04/2023

4:00 pm USA: Wholesale inventories, monthly (previously -0.4%).