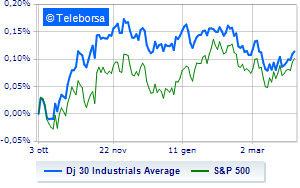

(Finance) – Wall Street continues the session at the levels recorded on the eve, reporting a change of +0.07% on Dow Joneswhile, on the contrary, theS&P-500 it advances fractionally, reaching 4,042 points. Positive the NASDAQ 100 (+0.75%); with analogous direction, just above parity theS&P 100 (+0.36%).

US gross domestic product grew 2.6% year-on-year in the fourth quarter of 2022. The growth of the US economy was thus revised downwards from +2.7% initially announced to +2.6%. Also today it was announced that in the United States the number of workers filing for unemployment benefits for the first time in the week ending March 25 rose to 198,000 against expectations for a figure of 195,000. The GDP data also revealed that the PCE inflation figure increased by 3.7% in the fourth quarter of 2022, in line with the second reading. In the third quarter it had recorded a +4.8%; in the second quarter a +7.3%.

In the S&P 500, the sub-funds performed well secondary consumer goods (+0.99%), informatics (+0.85%) and materials (+0.57%). The sector financialwith its -0.60%, is the worst on the market.

To the top between Wall Street giants, intel (+2.46%), Walt Disney (+1.18%), Walgreens Boots Alliance (+1.17%) and Chevrons (+0.85%).

The strongest sales, on the other hand, show up United Healthwhich continues trading at -0.90%.

Basically weak JP Morganwhich recorded a drop of 0.80%.

It moves below parity American Expressshowing a decrease of 0.75%.

Moderate contraction for Visawhich suffers a drop of 0.65%.

To the top between Wall Street tech giantsthey position themselves JD.com (+9.03%), PDD Holdings (+6.55%), Rivian Automotive (+2.95%) and Zoom Video Communications (+2.74%).

The strongest sales, on the other hand, show up Paychexwhich continues trading at -1.82%.

He suffers Regeneron Pharmaceuticalswhich shows a loss of 1.53%.

Undertone Dollar Tree showing a filing of 0.86%.

Disappointing Micron Technologywhich lies just below the levels of the eve.

Among macroeconomic appointments which will have the greatest influence on the performance of the US markets:

Thursday 30/03/2023

2.30pm USA: GDP, quarterly (exp. 2.7%; previous 3.2%)

2.30pm USA: Initial Jobless Claims, Weekly (Expected 196K; Previously 191K)

Friday 03/31/2023

2.30pm USA: Personal income, monthly (exp. 0.3%; prev. 0.6%)

2.30pm USA: Personal expenses, monthly (exp. 0.3%; prev. 1.8%)

3.45pm USA: PMI Chicago (exp. 43.6 points; previous 43.6 points).