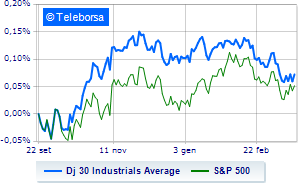

(Finance) – Slight increase for the New York Stock Exchange, which shows on Dow Jones an increase of 0.33%; along the same lines, theS&P-500 it advances fractionally, reaching 3,979 points. Positive the NASDAQ 100 (+0.8%); on the same trend, in cash theS&P 100 (+0.76%).

Banking stocks did well with First Republic Bank shares bouncing thanks to the words of the US Treasury Secretary Janet Yellen, which signaled that government protection is in place for smaller banks should the need arise. As tensions on the financial system ease, investors’ attention shifts to the key meeting of the US central bank. TomorrowThe Fed is to announce its interest rate decision on Wednesday, March 22. Expectations are for a 25 basis point hike rather than maintaining the status quo.

Featured prominently in the S&P 500 are the sub-funds power (+3.04%), financial (+2.14%) and secondary consumer goods (+2.10%). In the lower part of the classification of the S&P 500 basket, significant declines are manifested in the sectors utilities (-2.44%) and office consumables (-0.77%).

At the top of the rankings American giants components of the Dow Jones, American Express (+2.93%), JP Morgan (+2.63%), Goldman Sachs (+2.54%) and Nike (+2.43%).

The strongest declines, however, occur on intelwhich continues the session with -3.38%.

Moderate contraction for Procter & Gamblewhich suffers a drop of 1.49%.

Undertone Amgen showing a filing of 1.44%.

Disappointing Coca Colawhich lies just below the levels of the eve.

On the podium of the Nasdaq stocks, Enphase Energy (+7.24%), Lucid Group, (+6.79%), Tesla Motors (+6.63%) and zscaler, (+6.54%).

The worst performances, however, are recorded on American Electric Power Companywhich gets -4.01%.

At a loss Xcel Energywhich drops by 3.94%.

Prey of sellers intelwith a decrease of 3.38%.

They focus their sales on Exelonwhich suffers a drop of 3.32%.

Among the data relevant macroeconomics on US markets:

Tuesday 03/21/2023

3pm USA: Existing Home Sales, Monthly (Expected 5%; Previous -0.7%)

3pm USA: Sale of existing houses (expected 4.19 million units; previous 4 million units)

Wednesday 03/22/2023

3.30pm USA: Oil Inventories, Weekly (exp. 811K barrels; prev. 1.55M barrels)

Thursday 03/23/2023

1.30pm USA: Current Account, Quarterly (Exp. -$214B; Previous -217.1Bn)

1.30pm USA: Initial Jobless Claims, Weekly (Expected 199K; Previously 192K).