(Tiper Stock Exchange) – Brilliant Piazza Affari, which is in line with the excellent performance of the main European stock exchanges, with tensions on the financial system that seem to ease, after the rescue of Credit Suisse by UBS and the intervention of the authorities and central banks to stem the contagion effect. Meanwhile, investors’ attention turns to the key meeting of the US central bank. On hopes of a more “dovish” Fed, the US market shows a moderately positive trend for theS&P-500. US Treasury Secretary Janet Yellen said today that government protection is in place for smaller banks if needed.

On the American market, a slight increase forEuro / US Dollar, which shows an increase of 0.40%. Sales on thegold, which trades at $1,941.7 an ounce, down sharply by 1.89%. Sharp increase in oil (Light Sweet Crude Oil) (+1.33%), which reaches 68.72 dollars per barrel.

Go back down it spreadssettling at +175 basis points, with a drop of 5 basis points, while the yield on the 10-year BTP stands at 3.99%.

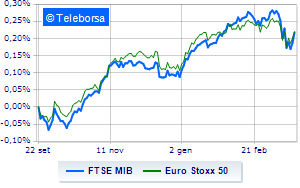

Among the indices of Euroland in evidence Frankfurtwhich shows a strong increase of 1.75%, soars London which marks an important progress of 1.79%; moves into positive territory Paris, showing an increase of 1.42%. Closing in sharp rise for the Milan Stock Exchange, with the FTSEMIB, which posts a gain of 2.53%; on the same line, closes with the wind in its sails FTSE Italia All-Sharewhich comes to 28,742 points.

On the Milan Stock Exchange, the value of trades in today’s session was equal to 2.41 billion euros, down by 785.9 million euros, compared to 3.2 billion on the previous day; volumes stood at 0.63 billion shares, up from 0.89 billion previously.

Between best performers of Milan, in evidence Saipem (+7.57%), Unicredit (+6.96%), Phinecus (+5.41%) and BPER (+4.89%).

The strongest sales, however, fell on ERGwhich finished trading at -0.73%.

He hesitates Triadwith a modest decline of 0.65%.

Slow day for amplifierwhich marks a decrease of 0.54%.

Between best stocks in the FTSE MidCap, Saras (+5.40%), Drums (+5.06%), Banca Popolare di Sondrio (+4.90%) and GV extension (+4.42%).

The strongest declines, however, occurred on Datalogicwhich closed the session at -1.49%.

Small loss for Luvewhich trades with -1.32%.

He hesitates El.Enwhich drops 1.22%.

Basically weak Salcef Groupwhich recorded a decrease of 0.73%.

Between macroeconomic variables heavier:

Tuesday 03/21/2023

11:00 am Germany: ZEW Index (expected 17.1 points; previous 28.1 points)

3pm USA: Existing Home Sales, Monthly (Expected 5%; Previous -0.7%)

3pm USA: Sale of existing houses (expected 4.19 million units; previous 4 million units)

Wednesday 03/22/2023

08:00 United Kingdom: Production prices, annual (expected 13.3%; previous 13.5%)

08:00 United Kingdom: Consumption prices, yearly (expected 9.8%; previous 10.1%).