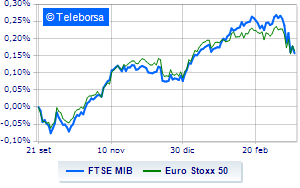

(Tiper Stock Exchange) – European share lists are recovering together with Piazza Affari, which achieved the same positive performance as the Old Continent, thanks to the excellent performance of energy and utilities and the lower pressure from sales on banks.

The Swiss encore UBS extension announced that will take over rival Credit Suisse, but at a price well below current values, which did not reassure the market much. The market did not like the announcement of thezeroing of AT 1 bonds which had been issued for a value of 17 billion e the reversal of the order of priority of the guarantees between shares and bonds announced by the European authorities, who then backtracked.

L’Euro / US Dollar continues the session higher and advances to 1.071. L’Gold the session continued just below parity, with a drop of 0.23%. Oil (Light Sweet Crude Oil) continues the session just below parity with a negative variation of 0.88%.

Salt it spreadssettling at +189 basis points, with an increase of 5 basis points, with the yield on the 10-year BTP equal to 3.91%.

In the European stock market scenario moderate gain for Frankfurtwhich advanced by 0.58%, small steps forward for Londonwhich marks a marginal increase of 0.40%, more toned Pariswhich marks a sharp increase of 0.83%.

The Milanese price list shows a modest gain, with the FTSEMIB which is achieving +0.66%; along the same lines, the FTSE Italia All-Share makes a small leap forward of 0.67%, reaching 27,791 points.

Positive the FTSE Italia Mid Cap (+0.86%); directionless the FTSE Italy Star (+0.12%).

Among the best Blue Chips of Piazza Affari, A2A advances by 2.80%.

It’s moving into positive territory snamshowing an increase of 2.21%.

Money up Triadwhich recorded an increase of 2.19%.

Very positive balance for Buzzi Unicemwhich boasts an increase of 2.10%.

The worst performances, however, are recorded on DiaSorinwhich gets -3.60%.

Prey of sellers Ivecowith a decrease of 2.07%.

They focus their sales on BPERwhich suffers a drop of 1.52%.

Moderate contraction for Leonardowhich suffers a drop of 0.81%.

At the top of the mid-cap rankings from Milan, Mortgages online (+6.11%), IREN (+5.26%), Fincantieri (+4.22%) and De’Longhi (+3.69%).

The strongest declines, however, occur on El.Enwhich continues the session with -6.04%.

Sales on Antares Visionwhich records a drop of 3.67%.

Bad sitting for Mfe Awhich shows a loss of 2.24%.

Under pressure GV extensionwhich shows a drop of 2.23%.