(Tiper Stock Exchange) – Euroland markets move positivelyin spite of theweak performance of the banking sectorwhich continues to discount the story of Credit Suisse and fears of contagion. Piazza Affari moves in the same wake with some interesting ideas on utilities and energy.

L’Euro / US Dollar is on the rise (+0.81%) and reaches 1.07. Seat in fractional decline for thegold, which leaves, for now, 0.63% in the open. Deep red for oil (Light Sweet Crude Oil), which continues trading at 65.2 dollars per barrel, down sharply by 2.31%.

The Spreads worsens, reaching +189 basis points, with an increase of 5 basis points compared to the previous value, with the yield on the ten-year BTP equal to 3.91%.

In the European stock market scenario small step forward for Frankfurtwhich shows a progress of 0.54%, nothing done for Londonwhich changes hands on parity, and composed Pariswhich grows by a modest +0.57%.

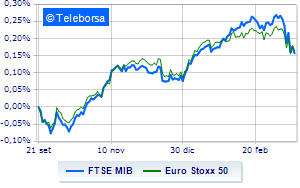

Piazza Affari continues the session with a fractional gain on FTSEMIB by 0.48%; along the same lines, a small step forward for the FTSE Italia All-Sharewhich comes in at 27,738 points.

Just above parity the FTSE Italia Mid Cap (+0.52%); almost unchanged FTSE Italy Star (+0.03%).

Between best performers of Milan, in evidence Triad (+3.60%), A2A (+3.16%), snam (+2.89%) and Italgas (+2.51%).

The worst performances, however, are recorded on DiaSorinwhich gets -3.12%.

The negative performance of BPERwhich drops by 1.92%.

Slow day for Saipemwhich marks a drop of 1.49%.

Small loss for Ivecowhich trades with -1.1%.

At the top of the mid-cap rankings from Milan, Mortgages online (+5.13%), IREN (+4.43%), Fincantieri (+4.03%) and De’Longhi (+3.69%).

The strongest sales, on the other hand, show up El.Enwhich continues trading at -6.04%.

Antares Vision drops by 2.93%.

Decided decline for Webuildwhich marks a -2.63%.

Under pressure GV extensionwith a sharp drop of 1.91%.