(Finance) – Downward compounding for Oracledown by 3.63% on previous values.

The software group closed the third quarter of fiscal 2023 with net profits of $1.9 billion, (68 cents per share) down from $2.3 billion (84 cents per share) during the same period a year ago. On an adjusted basis, however, EPS rose $1.13 to $1.22, versus $1.20 on analysts’ estimates.

THE revenues instead they grew from 10.5 to 12.4 billion dollars, substantially in line with the consensus.

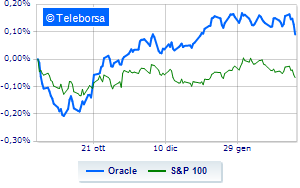

The trend of Oracle in the week, compared toS&P 100notes a lower relative strength of the stock, which could fall prey to sellers ready to take advantage of potential weaknesses.

The technical framework of Oracle it signals a widening of the negative trend line with a drop to the support seen at USD 82.65, while on the upside it finds the resistance area at 85.02. Forecasts are for a possible further retreat with a target set at 81.58.