(Finance) – Rain of sales on the US list, after Jerome Powell’s “hawkish” words. The chairman of the Federal Reserve, speaking to the Senate Banking Committee, anticipated a potentially even more aggressive monetary policy, if economic conditions permit.

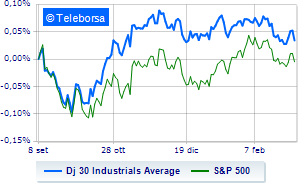

Among the US indices, the Dow Jones trades with a sharp drop of 1.53%; along the same lines, widespread sales on theS&P-500, which continues the day at 3,995 points. Down the NASDAQ 100 (-0.79%); with similar direction, in red theS&P 100 (-1.24%).

All sub-funds of the S&P 500 are down on Wall Street. In the lower part of the S&P 500 classification, significant declines are financial (-2.53%), materials (-2.00%) and utilities (-1.94%).

In this bad day for the New York Stock Exchange, no Blue Chip has a positive performance.

The strongest sales manifest on JP Morganwhich continues trading at -2.85%.

Bad sitting for Goldman Sachswhich shows a loss of 2.28%.

Under pressure Walgreens Boots Alliance,which shows a drop of 2.27%.

Slide Home Depotwith a clear disadvantage of 2.24%.

To the top between Wall Street tech giantsthey position themselves Advanced Micro Devices (+3.45%), Atlassian (+1.72%), AirBnb (+1.27%) and Nvidia (+1.24%).

The strongest declines, however, occur on Rivian Automotive,which continues the session with -10.64%.

Bad performance for Sirius XM Radiowhich records a drop of 4.53%.

Black session for Lucid Group,which leaves a loss of 3.97% on the table.

In red light up,which shows a marked decrease of 3.23%.

Between macroeconomic quantities most important of the US markets:

Tuesday 07/03/2023

4:00 pm USA: Inventories wholesale, monthly (exp. -0.4%; prev. 0.1%)

Wednesday 08/03/2023

2.15pm USA: Occupied ADP (Expected 195K units; Previous 106K units)

2.30pm USA: Trade balance (exp. -69 Bn $; prev -67.4 Bn $)

4.30pm USA: Oil Inventories, Weekly (previously 1.17 Mln barrels)

Thursday 09/03/2023

1.30pm USA: Challenger Layoffs (previously 102.94K units).