(Finance) – The main European stock exchanges continue under the banner of uncertainty with investors worried about the geopolitical risks linked to the Ukrainian crisis while awaiting the possible moves of the Federal Reserve after the minutes of the FOMC they evoked a more aggressive tightening on monetary policy.

On the currency market, theEuro / US dollar, which continues the session at the levels of the eve and stops at 1.136: the ECB in the economic bulletin, released this morning, has evoked upside risks for inflation. L’Gold, on the rise (+ 1.22%), reaches 1,891.6 dollars an ounce. Decisive rise in oil (Light Sweet Crude Oil) (-1.52%), which reaches 92.24 dollars per barrel.

Consolidate the levels of the eve it spreadsettling at +163 basis points, with the yield on the ten-year BTP standing at 1.88%.

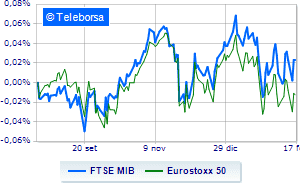

Among the European lists remains close to parity Frankfurt (+ 0.03%), subdued London showing a filing of 0.66%; sitting without momentum for Paris, reflecting a moderate increase of 0.34%. Weak session for the Milanese market, which trades with a drop of 0.32% on FTSE MIB; on the same line, depressed the FTSE Italia All-Sharewhich trades below the levels of the eve at 29,297 points.

Between best Italian stocks large cap, in evidence Moncler + 2.18% which, together with the rest of the luxury sector, follows the good performance of the French Kering thanks to the financial results.

In light Ferrariwith a large increase of 1.35%.

Small step forward for Amplifonwhich shows a progress of 0.84%.

Composed DiaSorinwhich grew by a modest + 0.74%.

The strongest sales, on the other hand, show up on Iveco Groupwhich continues trading at -1.85%.

BPER drops by 1.69%.

Decline for Mediobancawhich marks a -1.16%.

Under pressure Finecowith a sharp decline of 1.13%.

At the top among Italian stocks a mid cap, Carel Industries (+ 2.21%), Brunello Cucinelli (+ 1.99%), Salcef Group (+ 1.75%) e Brembo (+ 1.52%).

The worst performances, on the other hand, are recorded on Autogrillwhich gets -2.44%.

Bad performance for doValuewhich recorded a decline of 2.14%.

Black session for IGDwhich leaves a loss of 2.10% on the table.

Suffers Biessewhich shows a loss of 1.96%.