(Finance) – Shine Prysmianwhich changes hands with an increase of 4.04%, after announcing that it had been awarded two orders worth a total of around 1.8 billion euros awarded by the Dutch transmission system operator TenneT for two electricity grid connection projects which will connect the two future offshore wind farms located in the Dutch part of the North Sea to the province of Zeeland, located in the south-western part of the Netherlands.

These orders will increase the total value of Prysmian’s order book, bringing it to around 8.5 billion euro.

The title has been rewarded by analysts who recommend buying. This is the research office of Intesa SanPaolo which confirms the “buy” valuation and the target price at 45 euros. Even the Akros experts reiterate the “Buy” recommendation with a target price of 42.50.

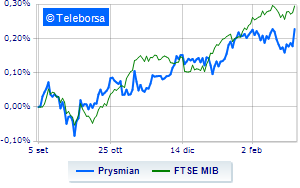

The analysis of the stock performed on a weekly basis highlights the bullish trendline of group specialized in the production of cables more pronounced than the trend of FTSEMIB. This expresses the market’s greater attractiveness towards the stock.

For the medium term, the technical implications assumed by Prysmian are still read in a negative key. On the other hand, some signs of improvement emerge for the short-term setting, read through the fastest indicators which show a decrease in the descent speed. At this point, a slowdown of the descent is possible, approaching 37.4 Euros. The most immediate resistance is estimated at 38.27. Expectations are for an intermediate reaction phase aimed at repositioning the technical picture on more balanced and target values at 39.14, to be reached in a reasonably short time.