(Finance) – Positive start for the Wall Street Stock Exchange, with the enthusiasm among investors galvanized by the positive effects of the reopening of the Chinese economy. An assist also comes from the statements of the Atlanta Fed official, Raphael Bostic: although the US central bank could be forced to do more, given the high inflation, the banker indicated that he is in favor of monetary tightening of 25 basis points, speaking also of a break during the summer of 2023.

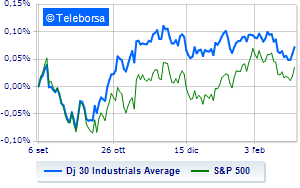

Among US indices, the Dow Jones is substantially stable and is positioned at 33,065 points, while, on the contrary, there is a slight leap forward for theS&P-500, which comes in at 3,997 points. Slightly positive the NASDAQ 100 (+0.48%); on the same trend, in fractional progress theS&P 100 (+0.45%).

Secondary consumer goods (+0.77%), telecommunications (+0.75%) and informatics (+0.68%) in good light on the S&P 500 list. Among the worst performers on the S&P 500 list, the sectors power (-1.32%) and office consumables (-0.55%).

Among the best Blue Chips of the Dow Jones, Salesforce, (+11.50%), intel (+3.43%), boeing (+2.69%) and Microsoft (+1.97%).

The strongest declines, however, occur on JP Morganwhich continues the session with -1.04%.

He hesitates Amgenwith a modest drop of 0.61%.

Between best performers of the Nasdaq 100, DexCom (+9.46%), Pdd Holdings Inc Sponsored Adr (+5.18%), Old Dominion Freight Line, (+4.77%) and zscaler, (+4.43%).

The strongest sales, on the other hand, show up Tesla Motorswhich continues trading at -5.85%.

Slide Micron Technologywith a clear disadvantage of 1.59%.

Slow day for Datadogwhich marks a drop of 1.49%.

Small loss for biogenwhich trades with -1.27%.

Between macroeconomic quantities most important of the US markets:

Friday 03/03/2023

3.45pm USA: Composite PMI (expected 50.2 points; previous 46.8 points)

3.45pm USA: PMI services (expected 50.5 points; previous 46.8 points)

4:00 pm USA: ISM non-manufacturing (exp. 54.5 points; previous 55.2 points)

Monday 06/03/2023

4:00 pm USA: Industry orders, monthly (previously 1.8%)

Tuesday 07/03/2023

4:00 pm USA: Wholesale inventories, monthly (previously 0.1%).