(Finance) – The Wall Street Stock Exchange is moving with mixed signs, confirming the cautious trend shown at the start of the session. Investor sentiment continues to be conditioned by fears of even more aggressive rate hikes by the Fed. These expectations were fueled by data released last Friday on the PCE index preferred by the central bank led by Jerome Powell used to monitor the inflation trend, which has rekindled the doubt that prices have not really tested the peak.

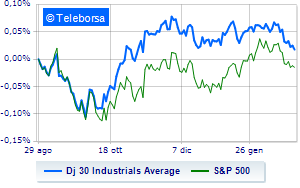

Among US indices, the Dow Jones is leaving 0.31% in the open, while, on the contrary, a slight increase for theS&P-500, which rises to 3,994 points. Moderately up the NASDAQ 100 (+0.56%); on the same trend, slightly positive theS&P 100 (+0.24%).

Featured prominently in the S&P 500 are the sub-funds materials (+1.02%), telecommunications (+0.84%) and informatics (+0.59%). At the bottom of the ranking, significant declines are manifested in the sector powerwhich reports a decrease of -0.94%.

To the top between Wall Street giants, Nike (+1.18%), American Express (+0.89%), Walgreens Boots Alliance, (+0.89%) and Home Depot (+0.76%).

The strongest declines, however, occur on Goldman Sachswhich continues the session with -2.67%.

Under pressure Merckwhich shows a drop of 2.04%.

He hesitates United Healthwhich drops 1.46%.

Basically weak Chevronswhich recorded a decrease of 0.95%.

Between best performers of the Nasdaq 100, Applied materials (+5.27%), Rivian Automotive, (+4.93%), Lucid Group, (+3.77%) and ansys, (+3.66%).

The strongest declines, however, occur on Constellation Energywhich continues the session with -2.55%.

Slide Keurig Dr Pepperwith a clear disadvantage of 2.15%.

In red Astrazenecawhich shows a marked decrease of 1.72%.

The negative performance of ASML Holdingwhich drops by 1.70%.

Among the data relevant macroeconomics on US markets:

Tuesday 02/28/2023

2.30pm USA: Inventories wholesale, monthly (exp. 0.1%; prev. 0.1%)

3pm USA: S&P Case-Shiller, annual (exp. 5.8%; previously 6.8%)

3pm USA: FHFA House Price Index, Monthly (Expected -0.2%; Previous -0.1%)

3.45pm USA: PMI Chicago (exp. 45 points; previous 44.3 points)

4:00 pm USA: Consumer confidence, monthly (expected 108.5 points; previous 106 points).