(Tiper Stock Exchange) – A day to forget for Wall Street, with stocks falling sharply and Treasury yields rising, after macroeconomic data released before the opening showed personal consumption spending rose more-than-expected in January, raising fears the Federal Reserve will keep interest rates higher for longer. In particular, the performance of the core PCE index is worryinga measure of inflation used by the US central bank.

“This it wasn’t the news the Fed or investors were hoping for and, therefore, we expect markets to adjust to the likelihood that the Fed will have to raise rates and hold them longer than previously anticipated,” commented Greg Wilensky, Head of US Fixed Income at Janus Henderson – Hottest inflation data, coupled with continued strength in the labor market and consumer spending, mean the Fed still has work to do on the inflation front.

The president of the United States himself Joe Bidensaid today’s report “shows we’ve made progress on inflation, but we still have a lot of work to do.”

Meanwhile, Loretta Masterchairman of the Federal Reserve Bank of Cleveland, said key interest rates need to climb above 5% and stay there for some time and that “the Fed needs to do a little more on our policy rate to make sure that inflation is coming back down”.

Philip Jeffersona member of the Federal Reserve Board of Governors, said instead that “the Federal Reserve is addressing the inflation explosion promptly and strongly to maintain that credibility and to keep long-term inflation expectations well anchored”.

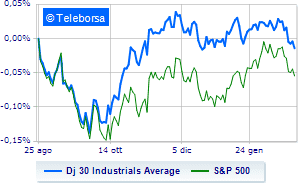

Bad day for the US Stock Exchangedown by 1.41% on Dow Jones; along the same lines, a day to forget for theS&P-500, which retreats to 3,950 points, retracing by 1.56%. Bad the NASDAQ 100 (-2.23%); with the same direction, theS&P 100 (-1.67%).

Only Blue Chip of the Dow Jones in substantial increase is JP Morgan (+0.59%).

The strongest sales, on the other hand, show up boeing, which continues trading at -4.86%. They focus their sales on Microsoft, which suffers a drop of 2.34%. Sales on Apple, which records a drop of 2.29%. Bad sitting for intelwhich shows a loss of 2.25%.

On the podium of the Nasdaq stocks, Intuition (+1.75%) and Mercadolibre, (+0.58%).

The strongest sales, on the other hand, show up Autodesk, which continues trading at -11.70%. Sensitive losses for Adobe Systems, down 7.53%. Breathless Lucid Group, which falls by 5.84%. Thump of Rivian Automotivewhich shows a fall of 5.78%.