(Tiper Stock Exchange) – Wall Street’s major stock indexes are set to end the week lowerafter they arrived in recent days numerous hawkish statements by Federal Reserve officials, who signaled the need to stay on course in the process of tightening monetary policy, with the aim of stifling inflation that is still too high.

“Undoubtedly, January’s nonfarm payrolls push up the risks for the arrival point of interest rates, but they also require a reading of the overall economic framework, for now consistent with a significant slowdown in aggregate demand, above all in the light of the signals from wages – wrote the economists of Intesa Sanpaolo – In the near term, the FOMC will remain hawkishwhile it will collect other data pending the March meeting, when the macroeconomic projections will be updated”.

Furthermore, the conclusion is approaching quarterly season, with more than half of the S&P 500 companies releasing their results. Among the most important names left there are Coca Cola, AIG extension, Kraft Heinz And Applied materialswho will communicate their results next week.

Meanwhile, PayPal (US company that offers digital payment and money transfer services) has achieved a quarterly above expectations and announced that CEO Dan Schulman will step down on December 31, 2023. Lyft (competitor of Uber in the ride sharing sector) communicated a disappointing guidance for the current quarter, despite the fact that the last three months of 2022 marked the record for revenues.

L’macroeconomic agenda lacked any significant data today (aside from University of Michigan Consumer Confidence), with traders expecting more important data next week. In fact, inflation, retail sales and industrial production for the month of January will be released.

On the front of analyst recommendations, Morgan Stanley has lowered the recommendation on Affirm a to “equal-weight” from “overweight”, Bank of America started the cover up Frey Battery with a “buy” and cut judgment on Deutsche Bank to “underperform” from “neutral”.

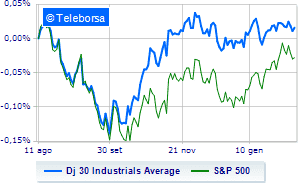

The New York Stock Exchange stops around paritywith the Dow Jones which stands at 33,678 points, while, on the contrary, theS&P-500, which recedes to 4,073 points. Slightly negative the NASDAQ 100 (-0.52%); on the same trend, slightly downS&P 100 (-0.25%).

Among the data relevant macroeconomics on US markets:

Friday 10/02/2023

4:00 pm USA: University of Michigan Consumer Confidence (expected 65 points; previous 64.9 points)

Wednesday 02/15/2023

4:00 pm USA: Industry Sales, Monthly (previously -0.8%)

4:00 pm USA: Industrial inventories, monthly (previously 0.4%)

4.30pm USA: Oil stocks, weekly

Thursday 02/16/2023

2.30pm USA: Unemployment Insurance Claims, Weekly.