(Finance) – The Wall Street stock exchange is confirmed as weak, at the halfway point, which discounts some profit taking and the possibility of new restrictive moves by the Fed, also in light of the latest numbers relating to the American labor market.

The US Bureau of Labor Statistics announced that in January there was an increase of 517,000 new jobs (in non-agricultural sectors), much higher than the consensus (+185,000 new jobs), while the unemployment rate is dropped to 3.4% (expectations at 3.6%).

In last week’s press conference, following the meeting in which the FOMC decided to raise rates by 25 basis points, Governor Jerome Powell acknowledged the current slowdown in the economy and used the term “disinflation” several times. Now the strong labor market gives the US central bank room to remain aggressive with its monetary policy.

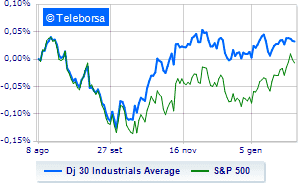

Among US indices, the Dow Jones stops at 33,896 points, while, on the contrary, theS&P-500 it has a depressed trend and trades below the previous levels at 4,111 points. Negative the NASDAQ 100 (-0.77%); along the same lines, slightly negative theS&P 100 (-0.56%).

At the top of the rankings American giants components of the Dow Jones, Honeywell International (+0.99%), boeing (+0.93%), Travelers Company (+0.88%) and Caterpillar (+0.60%).

The strongest declines, however, occur on intelwhich continues the session with -1.63%.

Thoughtful Procter & Gamblea fractional decline of 0.67%.

To the top between Wall Street tech giantsthey position themselves Idexx Laboratories, (+2.28%), Pinduoduo, Inc. Sponsored Adr (+2.09%), Starbucks (+1.56%) and biogen (+1.31%).

The strongest declines, however, occur on Align Technology,which continues the session with -2.71%.

Bad sitting for Advanced Micro Deviceswhich shows a loss of 2.33%.

Under pressure Marvell Technology,which shows a drop of 2.12%.

Slide document sign,with a clear disadvantage of 1.99%.

Among the data relevant macroeconomics on US markets:

Tuesday 07/02/2023

2.30pm USA: Trade Balance (Expected -68.5 Bn $; Previous -61.5 Bn $)

Wednesday 08/02/2023

4:00 pm USA: Inventories wholesale, monthly (exp. 0.1%; prev. 1%)

4.30pm USA: Oil Inventories, Weekly (exp. 376K barrels; prev. 4.14M barrels)

Thursday 09/02/2023

2.30pm USA: Initial Jobless Claims, Weekly (Expected 194K; Previously 183K)

Friday 10/02/2023

4:00 pm USA: University of Michigan Consumer Confidence (expected 64 points; previous 64.9 points).