(Finance) – The Wall Street stock market is on the rise, after an uncertain start, on the day the meeting of the FOMC begins, the monetary policy arm of the Federal Reserve led by Jerome Powell.

There is great anticipation for the verdict of the Fed which will arrive tomorrow: the market is betting on a rise in rates on fed funds by 25 basis points. In the last meeting of 2022, the FOMC raised rates by 50 points, slowing down after four consecutive 75bp tightening.

In the meantime, the quarterly season american.

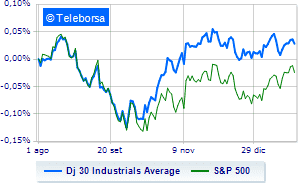

Among US indices, the Dow Jones advances to 33,871 points; along the same lines, theS&P-500 gains 0.78% over the previous session, trading at 4,049 points. Positive the NASDAQ 100 (+0.97%); as well, in cash theS&P 100 (+0.74%).

At the top of the rankings American giants components of the Dow Jones, Home Depot (+2.54%), United Health (+2.15%), Dow, (+2.01%) and 3M (+1.43%).

The worst performances, however, are recorded on Caterpillarwhich gets -3.24%.

Sales on McDonald’swhich records a drop of 2.09%.

Slack IBMwhich shows a small decrease of 0.99%.

On the podium of the Nasdaq stocks, Okta, (+5.76%), match groups, (+3.66%), Tesla Motors (+3.12%) and Lam Research (+3.10%).

The strongest declines, however, occur on Modernwhich continues the session with -3.64%.

Bad sitting for Baiduwhich shows a loss of 2.90%.

Under pressure Micron Technologywhich shows a drop of 2.74%.

Slide Sirius XM Radiowith a clear disadvantage of 1.62%.

Among the data relevant macroeconomics on US markets:

Tuesday 01/31/2023

2.30pm USA: Labor Cost Index, quarterly (exp. 1.1%; previous 1.2%)

3pm USA: S&P Case-Shiller, annual (exp. 6.8%; previously 8.7%)

3pm USA: FHFA House Price Index, Monthly (Expected -0.4%; Previous 0%)

3.45pm USA: PMI Chicago (exp. 45.1 points; previous 44.9 points)

4:00 pm USA: Consumer confidence, monthly (expected 109 points; previous 109 points).