(Finance) – The US stock continues the session just below parity, with investors’ attention remaining focused on the central banks which are betting on a less aggressive Fed in the light of the latest economic data. Meetings of the Fed, ECB and Bank of England are scheduled for this week. In the meantime, the quarterly season continues.

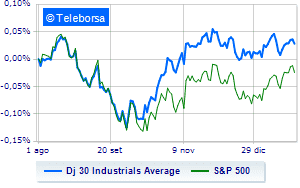

Among US indices, the Dow Jones he filed 0.30%, breaking the positive chain of six consecutive increases, which began on the 20th of this month; along the same lines, theS&P-500, which retreats to 4,035 points, retracing by 0.87%. Bad the NASDAQ 100 (-1.57%); on the same trend, negative theS&P 100 (-1.04%).

Negative performance in the States on all sectors of the S&P 500.

Among the best Blue Chips of the Dow Jones, American Express (+2.77%), Goldman Sachs (+1.93%), United Health (+1.14%) and Verizon Communication (+1.13%).

The worst performances, however, are recorded on Johnson & Johnsonwhich gets -2.96%.

Sales on Chevronswhich records a drop of 2.26%.

Bad sitting for Microsoftwhich shows a loss of 2.18%.

Under pressure Applewhich shows a drop of 1.80%.

On the podium of the Nasdaq stocks, O’Reilly Automotive (+2.69%), Baidu (+1.77%), Kraft Heinz (+1.52%) and Paychex (+1.34%).

The strongest declines, however, occur on Pinduoduo, Inc. Sponsored Adrwhich continues the session with -7.55%.

Heavy JD.comwhich marks a drop of as much as -5.84 percentage points.

Bad sitting for Lucid Group,which drops by 5.79%.

Sensitive losses for Nvidiadown 4.64%.

Between macroeconomic quantities most important of the US markets:

Tuesday 01/31/2023

2.30pm USA: Labor Cost Index, quarterly (exp. 1.1%; previous 1.2%)

3pm USA: S&P Case-Shiller, full year (exp 6.9%; previously 8.6%)

3pm USA: FHFA House Price Index, Monthly (Expected -0.4%; Previous 0%)

3.45pm USA: PMI Chicago (exp. 44.9 points; previous 44.9 points)

4:00 pm USA: Consumer confidence, monthly (expected 109 points; previous 108.3 points).