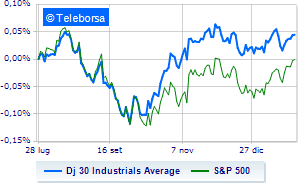

(Finance) – Wall Street starts trading hesitantly in the last session of the week, held back by the warning launched by Intel and by fears that the Fed will prolong its restrictive policy. The Dow Jones stops at 34,012 points; on the same line theS&P-500, which stands at 4,062 points. On the levels of the eve the NASDAQ 100 (+0.14%); with the same direction, consolidates the levels of the eve of theS&P 100 (+0.15%).

Strong nervousness and losses across the S&P 500 across all sectors, bar none.

To the top between Wall Street giants, American Express (+8.01%), Visa (+2.38%), JP Morgan (+0.60%) and Salesforce, (+0.57%).

The strongest declines, however, occur on intelwhich continues the session with -10.04%.

Sales on Chevronswhich records a drop of 3.01%.

He hesitates Verizon Communicationwhich dropped 1.04%.

Basically weak boeingwhich recorded a decrease of 0.86%.

On the podium of the Nasdaq stocks, Tesla Motors (+1.41%), Amazon (+1.29%), JD.com (+1.16%) and alphabet (+0.98%).

The worst performances, however, are recorded on intelwhich gets -10.04%.

Bad performance for KLA-Tencorwhich records a drop of 6.47%.

Bad sitting for Applied materialswhich shows a loss of 2.14%.

Under pressure Asml Holding Nv Adrwhich shows a drop of 2.08%.