(Finance) – Lively session today for Visaprotagonist of an upward stretch, with an increase of 2.45%.

The credit card group announced results for the first quarter of fiscal 2023, better than market expectations. During the period, net earnings rose from $3.96 billion, or $1.83 per share, to $4.18 billion ($1.99). On an adjusted basis, EPS rebounded 21% on the year to $2.18, versus the consensus $2.01.

Revenues also did well, growing to 7.94 billion dollars from the previous 7.06, higher than the 7.70 billion estimated by analysts.

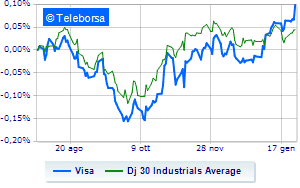

The comparison of the title with the Dow Joneson a weekly basis, shows the greatest relative strength of the global payments technology company compared to the index, highlighting the concrete attractiveness of the stock by buyers.

The short-term technical framework of Visa shows an upward acceleration of the curve with a target identified at 233 USD. Risk of a fall to 227.4 which will not affect the good health of the current trend but which represents a temporary correction. Expectations are for an extension of the uptrendline towards 238.6.