(Finance) – The Wall Street stock market continues to rise after an uncertain start in the last session of the week, conditioned by the warning launched by Intel and by fears that the Fed will extend its restrictive policy.

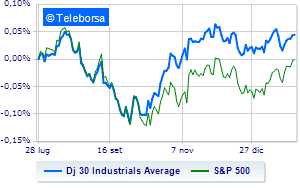

Among US indices, the Dow Jones continues session with fractional gain of 0.29%; along the same lines, slight increase forS&P-500, which rises to 4,076 points. In cash the NASDAQ 100 (+0.94%); as well, in fractional progress theS&P 100 (+0.65%).

Between protagonists of the Dow Jones, American Express (+11.98%), Visa (+2.71%), Walgreens Boots Alliance, (+2.66%) and Apple (+1.66%).

The worst performances, however, are recorded on intelwhich gets -7.78%.

Sensitive losses for Chevronsdown 5.04%.

Sales on Travelers Companywhich records a drop of 2.04%.

Moderate contraction for Merckwhich suffers a drop of 1.10%.

To the top between Wall Street tech giantsthey position themselves Tesla Motors (+10.70%), Lucid Group, (+9.28%), Old Dominion Freight Line, (+3.65%) and match groups, (+2.94%).

The worst performances, however, are recorded on intelwhich gets -7.78%.

Breathless KLA-Tencorwhich falls by 4.55%.

Bad sitting for O’Reilly Automotivewhich shows a loss of 3.45%.

Under pressure Applied materialswhich shows a drop of 3.31%.

Between macroeconomic variables of greatest weight in the North American markets:

Friday 01/27/2023

2.30pm USA: Personal income, monthly (exp. 0.2%; prev. 0.3%)

2.30pm USA: Personal expenses, monthly (exp. -0.1%; previous -0.1%)

4:00 pm USA: University of Michigan Consumer Confidence (expected 64.6 points; previous 59.7 points)

4:00 pm USA: Home sales in progress, monthly (exp. -0.9%; previous -2.6%)

Tuesday 01/31/2023

2.30pm USA: Labor cost index, quarterly (exp. 1.2%; previous 1.2%).