(Tiper Stock Exchange) – Blackstone reportedly in talks to sell about half of its stake in Embassy Office Parks to private equity firm Bain Capital. It is the largest real estate investment trust in India.

According to rumors, it would be a deal worth 480 million dollars at current prices.

Also according to rumors, the negotiations are in a preliminary stage and the agreement would mark Bain’s first REIT investment in India. For Blackstone, however, who continues to adjust his portfolio, it would be a further sale of his stake in Embassy.

Meanwhile on Wall Street the title Blackstone is posting a modest profit at +0.65%.

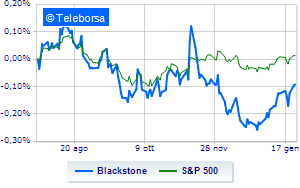

Comparatively on a weekly basis, the trend of Blackstone shows a more marked trend than the trendline of theS&P-500. This demonstrates the greater propensity of investors to buy towards Blackstone compared to the index.

The short term exam Blackstone it ranks a strengthening bull phase with immediate resistance seen at USD 90.01 and first support spotted at 87.03. Technically we expect a further upward trend of the curve towards new tops estimated in the 92.99 area.