(Tiper Stock Exchange) – Difficult day for Piazza Affari, which trades heavily, together with the other Eurolists. Fears of a global recession have resurfaced, encouraging some profit taking after the rally earlier in the year. Investors continue to weigh statements from policymakers and bankers al World Economic Forum in Davos.

On the central bank front, the president of the ECB Christine Lagarde he said Frankfurt would stay on course “until we’ve moved into restrictive territory for long enough to get inflation back to 2% in a timely manner.”

Among the heavyweights of the banking industry, the CEO of Deutsche Bank Christian Sewing supported the efforts of the ECB, calling the increase in consumer prices “poison” for the economy, while the CEO of UniCredit Andrew Orcel He said Europe could see slightly positive growth this year, although risks including war in Ukraine and rising borrowing costs remain.

Slight increase forEuro / US Dollar, which shows an increase of 0.27%. Slight increase ingold, which rises to 1,909.4 dollars an ounce. Sitting on parity for the petrolium (Light Sweet Crude Oil), which stands at $78.86 per barrel.

Back to climb it spreadscoming in at +181 basis points, an increase of 5 basis points, with the yield of 10-year BTP equal to 3.83%.

Among the main European Stock Exchanges it collapses Frankfurtwith a decrease of 1.65%, sales are concentrated on Londonwhich suffers a decline of 1.19%, and sales are hands-on Pariswhich suffers a decrease of 1.64%.

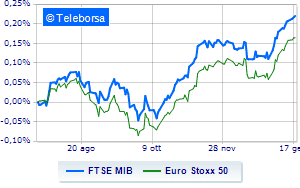

“No” day for the Italian stock exchangedown by 1.50% on FTSEMIB, breaking the positive chain of six consecutive hikes, which began on the 11th of this month; along the same lines, the FTSE Italia All-Share it lost 1.47%, continuing the session at 27,817 points. Down the FTSE Italia Mid Cap (-1.33%); along the same lines, heavy the FTSE Italy Star (-1.53%).

Among the best Blue Chips of Piazza Affari, modest performance for Leonardo, which shows a moderate increase of 1.27%. Resistant Ivecowhich marks a small increase of 1.03%.

The strongest sales, on the other hand, show up Tenaris, which continues trading at -4.27%. Sales on Saipem, which records a drop of 2.97%. Bad sitting for Pirelli, which shows a loss of 2.82%. Under pressure snamwhich shows a drop of 2.81%.

At the top of the mid-cap rankings from Milan, GV extension (+8.15%), wiit (+2.13%), Saras (+1.68%) and Ariston Holding (+0.84%).

The strongest sales, on the other hand, show up Dry, which continues trading at -4.10%. Bad performance for IREN, which records a drop of 3.97%. Slide MARR, with a clear disadvantage of 3.70%. In red Replywhich shows a marked decrease of 3.45%.