(Tiper Stock Exchange) – European equities moved littlewho suffers the fears of a slowdown of the Chinese economy (it closed 2022 with a +3% GDP, on the lowest since the 70s mainly due to the Zero Covid policy). Investors, who are watching Davos for statements from central bankers and policymakers, are also waiting for the quarterly Of Goldman Sachs And Morgan Stanley out today. Q4 2022 earnings will be a key catalyst this week as traders evaluate whether companies have been able to navigate headwinds, including higher interest rates.

On the macroeconomic front, Istat confirmed that Italian inflation was +11.6% year on year in December, while Destatis confirmed that i consumer prices in Germany they increased 8.6% year on year in the same month. The number of unemployed persons applying for a subsidy in the United Kingdom increased slightly, while the unemployment rate remained stable.

On the monetary policy front, Philip Lane he said the European Central Bank (ECB) needs to “raise rates more” and that it needs to “get them into restrictive territory”.

On FTSEMIB stands out the rise of Leonardowhich benefits from the “buy” promotion of Goldman Sachs, with a target price of 11.7 euros per share. Well too STM extensionwith the start of coverage at “overweight” by Barclayswith a target price of 60 euros per share.

On the Euronext Growth Milan market (EGM), are gaining ground Alfonsino (revenues up to €4.6 million in 2022, +17%) e FOPE (revenues up to 62.2 million in 2022, +54%).

L’Euro / US Dollar the session continued at the previous levels, reporting a variation of +0.01%. Weak session forgold, trading down 0.60%. Seat up slightly for the petrolium (Light Sweet Crude Oil), which advanced at $79.25 per barrel.

Slightly up spreadswhich stands at +191 basis points, with a timid increase of 4 basis points, with the yield of 10-year BTPs equal to 4.06%.

Among the indices of Euroland flat Frankfurtwhich holds parity, without cues Londonwhich does not show significant changes in prices, and stops Pariswhich marks an almost nothing done.

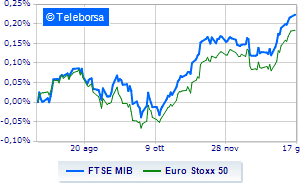

It moves fractionally down Business Squarewith the FTSEMIB which is leaving 0.61% in the open, halting the series of four consecutive hikes that began last Wednesday; along the same lines, depressed the FTSE Italia All-Sharewhich trades below the previous day’s levels at 27,893 points.

On equality the FTSE Italia Mid Cap (+0.15%); in fractional decline the FTSE Italy Star (-0.22%).

Between best Italian stocks large-cap, incandescent Leonardo, which boasts an incisive increase of 3.86%. Positive trend for Tenaris, which increases by a fair +2.25%. Well bought Register, which marks a sharp rise of 1.75%. Resistant STMicroelectronicswhich marks a small increase of 1.16%.

The worst performances, however, are recorded on Phinecus, which gets -2.84%. Under pressure BPM desk, with a sharp drop of 2.42%. He suffers Iveco, which shows a loss of 2.09%. Prey of sellers Intesa Sanpaolowith a decrease of 2.06%.

Between best stocks in the FTSE MidCap, Juventus (+3.36%), Mfe A (+2.72%), CIR (+1.87%) and Webuild (+1.77%).

The worst performances, however, are recorded on Mortgages online, which gets -1.38%. Undertone Sesa showing a filing of 1.28%. Disappointing Soul Holding, which lies just below the levels of the eve. Slack Tod’swhich shows a small decrease of 0.92%.