(Finance) – Modest income for Coca Colawhich is up by 0.53%.

The beverage giant ended 2021 with net operating revenues up by 17% at $ 38.6 billion while net profit reached $ 9.7 billion (+ 26% compared to 2020). On an adjusted basis, EPS stood at $ 0.45 against the consensus $ 0.41.

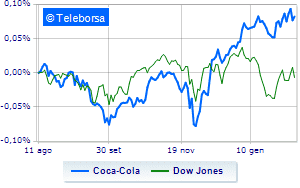

At a comparative level on a weekly basis, the trend of American giant of the most famous drink in the world shows a more marked trend than the trendline of Dow Jones. This demonstrates the greater propensity to buy by investors towards Coca Cola with respect to the index.

The medium-term status reaffirms the positive phase of Coca Cola. However, when analyzed in the short term, Coca Cola shows a less intense trend of the bullish trend at the test of the top 62.32 USD. First support at 60.38. The technical implications lean towards a short-term bearish development towards the imminent bottom estimated at 59.4.