(Finance) – After a momentary deterioration following the release of the quarterly reports of the major US banks and the off-key opening of Wall Street, the European stock exchanges they went up again, closing the last session of the week positively. Piazza Affari is lagging behind, on a negative day for the automotive sector and weak for the financial sector.

European markets they therefore continue to rise in this first part of 2023also thanks to the comfort coming from the Chinese reopening and from the US macroeconomic data (yesterday the data on the decrease in US inflation in December was greeted with a sigh of relief), even if several problems remain lurking.

“There economic growth remains close to zero in the Eurozone, with downside risks mitigated by the mild climate, energy subsidies and a far more expansionary fiscal policy – comments Mark Dowding, CIO of BlueBay – The ECB seems firmly intent on raising rates above 3% and keeping them such until the end of the year”.

On macroeconomic frontIstat communicated that in November 2022 the industrial production Italy continued to decline, disappointing expectations, albeit to a lesser extent than in the previous two months. By contrast, eurozone production grew more than expected in the same month, thanks to the expansion in the production of capital goods and intermediate goods.

According to Prometeia, the concerns are not abating: “Uncertainty not only remains high but signs of concern are intensifying – he explains in a note – In particular, in this first part of the year the risk of a brake on global activity is increasing, in the event that there is a sharp increase in infections in China following the abandonment of the zero-Covid strategy ” .

Several stocks in Piazza Affari have moved following the change in the analyst recommendations. Mediobanca has indicated Unicredit, Poste Italiane, BPER, Enel, Stellantis, Buzzi Unicem and Inwit as “top picks” for 2023 in Piazza Affari. Deutsche Bank instead saw an increase in the target prices of some large Italian utilities (Italgas, Snam, Terna).

Tear ePricewhich filed the appeal to request the approval of the restructuring agreements of the company’s debts in a state of crisis.

Strong downside for Unieurowho accuses 9 month results closed with a 65% decline in adjusted EBIT.

Seat in fractional decline for theEuro / US Dollar, which leaves, for now, 0.41% in the open. Positive session forgold, which is taking home a gain of 0.77%. Sharp increase of petrolium (Light Sweet Crude Oil) (+1.48%), which reaches 79.55 dollars per barrel.

Consolidate the levels of the eve lo spreadscoming in at +187 basis points, with the yield of 10-year BTP which stands at 3.98%.

Among the main European Stock Exchanges essentially unchanged Frankfurtwhich reports a moderate +0.19%, a positive trend for Londonwhich advanced by a fair +0.7%, and resilient Pariswhich marks a small increase of 0.69%.

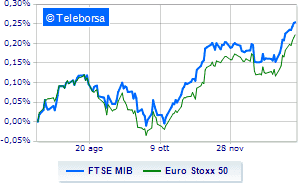

Basically stable Business Squarewhich archives the session on the previous levels with the FTSEMIB which stops at 25,783 points, while, on the contrary, the FTSE Italia All-Share it advances fractionally, reaching 27,843 points.

Salt the FTSE Italia Mid Cap (+0.87%); on the same trend, positive the FTSE Italy Star (+1.32%).

On the Milan Stock Exchange, the exchange value in today’s session it amounted to 2.19 billion euro, remaining unchanged compared to the previous session; volumes traded went from 0.65 billion shares in the previous session to 0.7 billion today.

Between best Italian stocks large-cap, well-bought BPERwhich marks a sharp rise of 3.25%.

BPM desk advances by 2.96%.

It’s moving into positive territory Ivecoshowing an increase of 2.84%.

Money up Monclerwhich recorded an increase of 2.77%.

The worst performances, however, were recorded on Stellantiswhich closed at -3.66%.

Slow day for Triadwhich marks a decrease of 1.00%.

Small loss for General Bankwhich trades with -0.84%.

He hesitates Pirelliwhich drops 0.78%.

At the top among Italian stocks a mid-cap, Reply (+4.45%), SOL (+3.91%), El.En (+2.40%) and CIR (+2.37%).

The worst performances, however, were recorded on Mfe Awhich closed at -2.13%.

Under pressure Juventuswhich shows a drop of 1.95%.

Slide Mfe Bwith a clear disadvantage of 1.92%.

Basically weak GV extensionwhich recorded a decrease of 1.31%.