(Finance) – The budget remains cautious, but positive for the positive European markets with the spotlights always focused on inflation and central bank moves. The inflation figure in the United States, which marked a clear reduction in December, is fueling expectations of a slowdown in the pace of monetary policy tightening by the Federal Reserve.

Today’s session will also be led by the American companies that kick off the quarterly season with the accounts of the big banks: JP Morgan, Citi, Bank of America and Wells Fargo.

On the foreign exchange market, theEuro / US Dollar the session continued just below parity, with a drop of 0.36%. Slight increase forgold, which shows an increase of 0.27%. Oil (Light Sweet Crude Oil), up (+1.06%), reaches 79.22 dollars per barrel.

The Spreads takes a small step downwards, with a drop of 1.46% to +182 basis points, while the yield on the 10-year BTP stands at 3.90%.

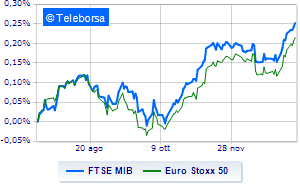

In the European stock market scenario resistant Frankfurtwhich marks a small increase of 0.21%, London it advances by 0.47%, and moves modestly higher Paris, showing an increase of 0.37%. Slight increase for the Milan Stock Exchange, which shows on FTSEMIB an increase of 0.23%; along the same lines, a small step forward for the FTSE Italia All-Sharewhich comes in at 27,921 points.

Between best performers of Milan, in evidence BPM desk (+3.63%), BPER (+3.06%), ERG (+2.52%) and amplifier (+2.51%).

The strongest declines, however, occur on Stellantiswhich continues the session with -3.59%.

Basically weak Pirelliwhich recorded a decrease of 1.31%.

It moves below parity Camparishowing a decrease of 0.63%.

Moderate contraction for Triadwhich suffers a drop of 0.62%.

At the top of the mid-cap rankings from Milan, MPS Bank (+3.43%), SOL (+3.40%), Reply (+3.21%) and Carel Industries (+2.44%).

The strongest sales, on the other hand, show up Luvewhich continues trading at -1.51%.

Undertone Juventus showing a filing of 1.42%.

Disappointing Soul Holdingwhich lies just below the levels of the eve.

Slack Antares Visionwhich shows a small decrease of 0.92%.

Among macroeconomic appointments which will have the greatest influence on the performance of the markets:

Friday 01/13/2023

08:00 United Kingdom: Industrial Production, YoY (exp. -3%; previous -4.7%)

08:00 United Kingdom: Industrial Production, Monthly (exp. -0.3%; previous -0.1%)

08:45 France: Consumption prices, monthly (exp. -0.1%; previous 0.3%)

08:45 France: Consumption prices, annual (expected 5.9%; previous 6.2%)

9:00 am Spain: Consumption prices, monthly (0.3% expected; previous -0.1%).