(Tiper Stock Exchange) – After an uncertain start, Wall Street turns positive after that one key inflation reading was in line with expectations, raising hopes that the Federal Reserve will take a less aggressive approach at its next monetary policy meeting. The consumer price index for the month of December 2022 fell by 0.1% month-on-month and increased by 6.5% year-on-year (the smallest increase since October 2021). Remaining in the macroeconomic field, the new ones have fallen slightly claims for unemployment benefitsagainst expectations for a weekly increase.

“Today’s data could have been relevant to the Fed, or at least would have been if it had moved more significantly, in one direction or another,” said Eric Winograd, Senior VP and US Economist at AllianceBernstein – Instead, the Today’s numbers weren’t convincing enough to determine whether the Fed will hike rates 25 or 50 points percentages at next month’s meeting.”

Meanwhile, the president of the Federal Reserve Bank of Philadelphia, Patrick Harkersaid the central bank should raise interest rates with quarter-point increments “in the future”as it nears the end point of its aggressive tightening campaign.

On the front of corporate announcementsthe board of directors of Walt Disney Company appointed independent director Mark G. Parker as the new chairman. American Airlines expects fourth-quarter 2022 total revenue and earnings to increase more than its prior estimate. Logitech it missed earnings expectations for the latest quarter and significantly reduced its sales outlook.

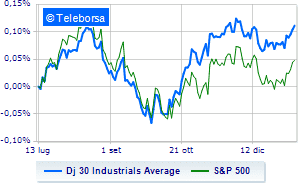

The Dow Jones shows a gain of 0.85%, continuing the bullish trend highlighted by three consecutive gains, triggered last Tuesday; on the same line, small leap forward for theS&P-500, which comes in at 3,993 points. Slightly positive the NASDAQ 100 (+0.61%); along the same lines, in fractional progress theS&P 100 (+0.6%).

To the top between Wall Street giants, Walt Disney (+4.15%), boeing (+3.14%), Caterpillar (+2.44%) and Salesforce, (+2.23%).

The strongest sales, on the other hand, show up Amgenwhich continues trading at -0.67%.

Thoughtful Cokea fractional decline of 0.52%.

To the top between Wall Street tech giantsthey position themselves Cognizant Technology Solutions (+8.23%), Mercadolibre, (+6.63%), Marvell Technology, (+4.03%) and AirBnb (+3.79%).

The strongest sales, on the other hand, show up Illuminatewhich continues trading at -3.77%.

zscaler, drops by 3.17%.

Decided decline for Tesla Motorswhich marks a -2.08%.

Under pressure Cintaswith a sharp drop of 1.79%.