(Tiper Stock Exchange) – Sabafin execution of the shareholders’ resolution of 28 April 2022 and the resolution of the Board of Directors of 20 December 2022, communicated the launch of a treasury share buyback programme.

The Buyback Plan will be implemented to service extraordinary transactions as envisaged by the aforementioned shareholders’ resolution.

The deeds of purchase will be carried out, even in part and/or in fractions, for a total outlay up to a maximum of 2,700,000 euros and, in any case, no more than 100,000 ordinary shares (equal to 0.867% of the share capital). Furthermore, the number of shares to be purchased daily cannot exceed 25% of the average daily volume traded, calculated on the basis of the average daily trading volume in the 20 trading days preceding each purchase date.

The shopping they will be started in the week of January 9, 2023 and it is expected that will end by 27 October 2023.

Sabaf has given a mandate to Equita SIM to coordinate and execute the Buyback Plan and take the negotiating decisions relating to the programme, with discretion and in full independence.

The program may also be executed only partially and its execution may be modified or revoked at any time and simultaneously communicated to the market.

As at 9 January 2023, Sabaf held 214,863 treasury shares in its portfolio, equal to 1.863% of the share capital and the subsidiaries did not hold Group shares.

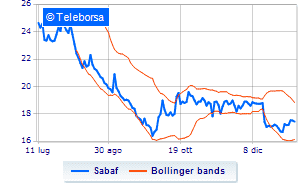

On the stock exchange, today, fractional decline for the manufacturer of components for domestic gas cooking applianceswhich closed the trades with a loss of 0.46%.